The global carbon market is entering a new era of institutionalization and compliance. Governments are now designing frameworks that reflect their economic structures and emission realities, transforming voluntary initiatives into state-backed carbon economies. The age of purely voluntary offsets is ending. Carbon credit markets are increasingly defined by government authorization, international alignment, and high integrity.

This carbon market analysis examines carbon credit market trends shaping the global transition to compliance-driven systems, covering Article 6 of the Paris Agreement, Europe’s expanding ETS and CBAM systems, Asia’s rapidly developing frameworks, and the aviation sector’s CORSIA mechanism. Together, these developments show how carbon markets are becoming the backbone of global climate finance.

At the core of global carbon credit market integrity lies Article 6 of the Paris Agreement, the only international mechanism that enables countries to transfer and trade emission reductions (ITMOs) within a transparent and double-count-free framework. By establishing clear rules for authorization, transparency, and environmental integrity, Article 6 defines what constitutes a legitimate and internationally recognized credit.

Across developing regions, frameworks for Article 6 implementation are now taking shape. In Africa, some countries are introducing national Carbon Frameworks, clarifying the procedures for Letters of Authorization (LoA) and opening participation to private developers.

This growing collaboration between governments and the private sector marks a structural shift from voluntary offsetting toward authorized trading. The carbon credit market outlook 2025 reflects this transformation, with government authorization becoming the primary indicator of credit quality. It helps buyers identify high-integrity credits with confidence and enables smoother approval processes, which are essential to scaling credible climate finance worldwide.

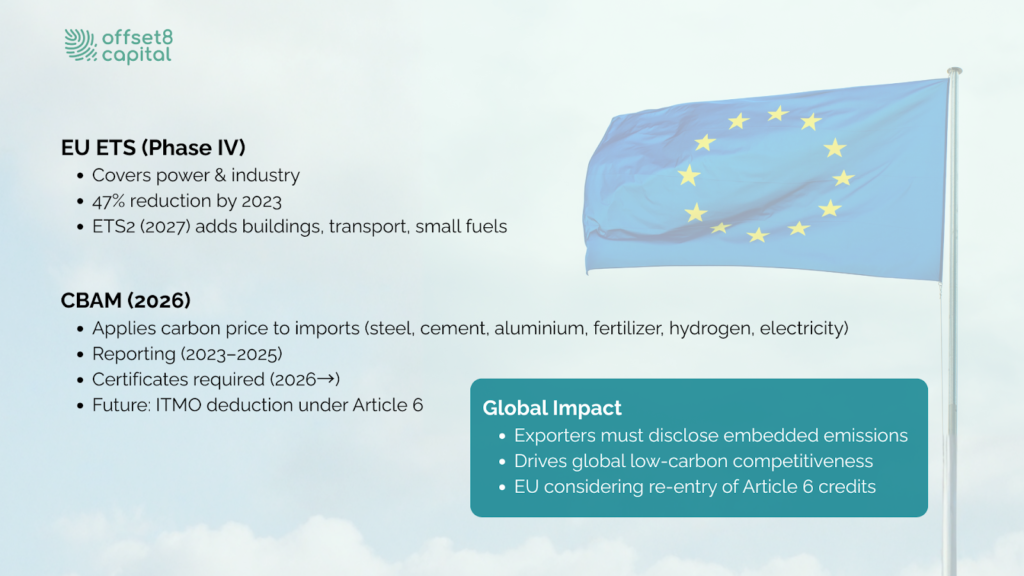

Fig1: Europe’s Expanding Carbon Market Framework

Launched in 2005, the EU Emissions Trading System (EU ETS) remains the world’s most established carbon market and the foundation of Europe’s climate policy.

By 2023, emissions from the power and industrial sectors had fallen 47 percent below 2005 levels, proving that carbon pricing drives measurable decarbonization. Under Phase IV (2021 to 2030), the system targets a 62 percent reduction by 2030.

In 2024, the ETS expanded to maritime transport, and in 2027, ETS 2 will extend coverage to buildings, road transport, and small fuel users, embedding carbon costs into daily economic activity.

The Carbon Border Adjustment Mechanism (CBAM) will become fully operational on January 1, 2026, marking the world’s first large-scale border carbon pricing system.

It applies a carbon price to imported goods such as steel, cement, aluminium, fertilizers, hydrogen, and electricity, preventing carbon leakage and ensuring that EU decarbonization efforts are not undermined by higher-emission imports.

During the transitional phase (2023–2025), importers are required only to report the embedded emissions of their imported products.

From 2026 onward, they will need to purchase and surrender CBAM certificates that mirror the EU ETS carbon price.

If a carbon price has already been paid in the country of origin, the corresponding amount will be deducted from the obligation.

In the future, Article 6–authorized Internationally Transferred Mitigation Outcomes (ITMOs) may also qualify for such deductions, promoting international cooperation under the Paris Agreement.

CBAM is reshaping global trade competitiveness.

Exporters to the EU must disclose product-level embedded emissions, pushing industries to adopt more transparent data systems and lower-carbon supply chains.

For producers in Asia and the Middle East, where energy-intensive exports to Europe remain significant, competitiveness increasingly depends on demonstrating low-emission production capacity.

Looking ahead, the EU’s 2040 climate roadmap includes discussions on reintroducing high-quality international credits aligned with Article 6 into its compliance system.

Such integration could bridge the gap between voluntary and regulated markets and accelerate the creation of a unified global carbon pricing framework.

To prepare for full implementation, the EU adopted Regulation (EU) 2025/2083 in October 2025, amending the original CBAM framework (Reg. 2023/956). This reform simplifies administrative procedures, enhances compliance clarity, and ensures a smoother transition from the reporting phase to the operational phase. Key revisions include:

This reform strengthens CBAM’s administrative efficiency while preserving environmental integrity, reaffirming the EU’s leadership in developing fair and enforceable border carbon rules.

Japan and Indonesia

Asia's carbon credit market growth 2025 is driven by rapid institutionalization, with governments moving from pilot programs to binding compliance frameworks.

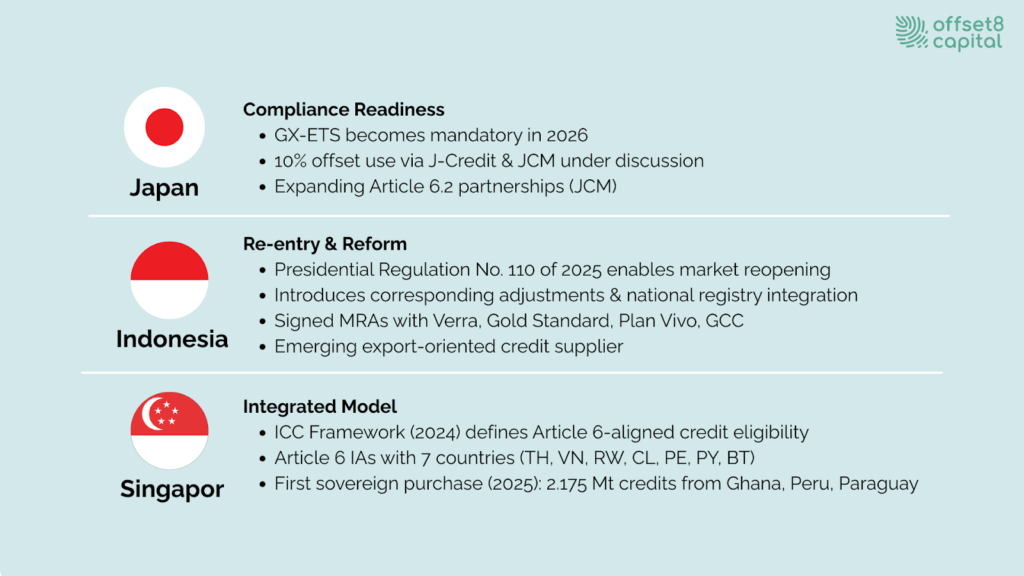

Fig2: Policy Acceleration and Integration Across Asian Carbon Markets

Japan plans to make its GX-ETS (Green Transformation ETS) mandatory in 2026, allowing inter-company credit trading as a cost-effective decarbonization measure. Policymakers are discussing offset use of up to ten percent through J-Credits and JCM units. Meanwhile, the Joint Crediting Mechanism (JCM) continues to expand globally, with India joining as the thirty-first partner country in September 2025. This reinforces Article 6.2–based cooperation across emerging economies.

Indonesia re-entered international carbon trading in October 2025 through Presidential Regulation No. 110 of 2025, marking its most comprehensive policy reform in four years. The new regulation introduces corresponding adjustments, registry integration, and full transparency standards, aligning Indonesia’s framework with international best practice. Through Mutual Recognition Agreements (MRAs) with Gold Standard, Plan Vivo, Global Carbon Council, and Verra. Indonesia has reconnected its projects to global markets and is positioning itself as an emerging export-oriented credit supplier under Article 6.

Singapore

Singapore has built one of the most advanced carbon market systems by integrating domestic taxation with international credit mechanisms.

In 2024, it launched the International Carbon Credit (ICC) Framework, which clearly defines the eligibility criteria for Article 6–aligned credits and allows companies to offset up to five percent of taxable emissions using verified international units.

At the same time, the government increased the national carbon tax to SGD 25 per ton, establishing a firm domestic price floor while keeping access to credible global credits open.

By signing Article 6 Implementation Agreements (IAs) with Thailand, Vietnam, Rwanda, Chile, Peru, Paraguay, and Bhutan, Singapore created a network for authorized ITMO transactions, strengthening its role as Asia’s carbon-trading and finance hub.

In 2025, the Singapore government finalized its sovereign-level purchase of 2.175 million tonnes of high-quality nature-based carbon credits from four projects in Ghana, Peru, and Paraguay. This followed a request for proposal (RFP) launched in September 2024 to support Singapore’s 2030 NDC under the Paris Agreement. The government also launched its first open call for international project proposals focusing on high-integrity mitigation activities such as reforestation, clean cookstoves, and sustainable water systems. This framework not only secures a long-term supply of credible credits but also channels finance toward developing economies capable of delivering measurable climate benefits.

Singapore’s approach demonstrates how domestic policy, private-sector participation, and international cooperation can operate in harmony under the Paris Agreement to build transparent and scalable carbon markets.The Singapore carbon credit market exemplifies best practices for Article 6 implementation and government-led credit procurement in 2025.

Industry-Led Compliance: CORSIA and the Future of Aviation

The aviation industry has entered its compliance phase through CORSIA, the Carbon Offsetting and Reduction Scheme for International Aviation, led by the International Civil Aviation Organization (ICAO). Airlines must offset any increase in international flight emissions above 2019 levels using credits that are Paris-aligned and corresponding-adjusted.

CORSIA represents the first global mechanism connecting governments, corporations, and markets under a single integrity standard.

Eligible credits must meet strict requirements for monitoring, reporting, verification, transparency, and double-count prevention. Although supply remains limited, demand from participating airlines continues to grow, pushing prices of high-integrity credits upward and attracting greater investment in both reduction and removal projects.

CORSIA is also providing a model for other transport sectors such as shipping and logistics, expanding the reach of compliance-driven carbon markets.

This carbon credit market analysis demonstrates how global carbon credit markets have evolved beyond a voluntary offset ecosystem into a policy-anchored financial system where governments, standards, and investors operate through shared integrity principles. Market value is now determined not only by emission reductions but also by transparency, policy alignment, and readiness for compliance.

For investors and corporations, the strategic priority is to focus on LoA-authorized and Article 6–aligned credits, understand corresponding adjustment mechanisms, and build portfolios that reflect emerging national and international policies. The carbon credit market outlook in 2025 favors participants who treat regulation as an investment framework rather than a limitation.

Future growth in the carbon market will depend on the ability to turn compliance into competitiveness and integrity into long-term value. Those who act early, align deeply, and invest with conviction will shape the foundation of the carbon economy in the coming decade.

Article 6 is establishing a global framework for government-authorized and internationally aligned credits, which is increasing interest in LoA-backed, high-integrity assets.

The EU ETS has cut industrial emissions by 47 percent since 2005. CBAM now extends this cost to imports like steel and aluminium, raising global demand for transparent and verifiable low-carbon production.

Japan, Indonesia, and Singapore are advancing Article 6 systems, while Zambia and Malawi are building national Carbon Frameworks. These early-stage yet fast-maturing markets offer strong long-term potential for investors entering the compliance-aligned carbon economy.