Institutional investors and policy experts face unprecedented opportunities in carbon negative markets, where sophisticated climate finance mechanisms converge with measurable environmental impact. This comprehensive analysis explores how carbon negative strategies transform portfolios while delivering returns that extend beyond traditional metrics. Understanding what it means to be carbon negative shapes investment decisions that will define the next decade of climate finance in the fight against climate change.

Carbon negative represents a transformative approach where entities remove more carbon from the atmosphere than it emits, creating a net beneficial impact on global emissions.

When organizations achieve carbon negative, they actively reverse their environmental carbon footprint through sophisticated carbon removal mechanisms that exceed their total amount of greenhouse gas emissions. This concept of carbon transcends traditional carbon neutrality by requiring measurable extraction of carbon dioxide removed from the atmosphere.

For institutional investors, understanding what carbon negative actually means involves recognizing the fundamental difference between offsetting and genuine atmospheric carbon removal — a distinction that drives investment value and policy compliance.

The journey to reach carbon negative begins with understanding carbon sequestration processes that transform atmospheric carbon dioxide into stable, long-term storage. Natural carbon sinks like forests and soils operate through photosynthesis, while engineered solutions employ direct air capture and geological storage technologies. These mechanisms form the scientific backbone of investment-grade carbon removal technologies.

The carbon cycle provides the foundation for evaluating project permanence. Verification standards in turn ensure that investments deliver genuine atmospheric carbon removal rather than temporary displacement.

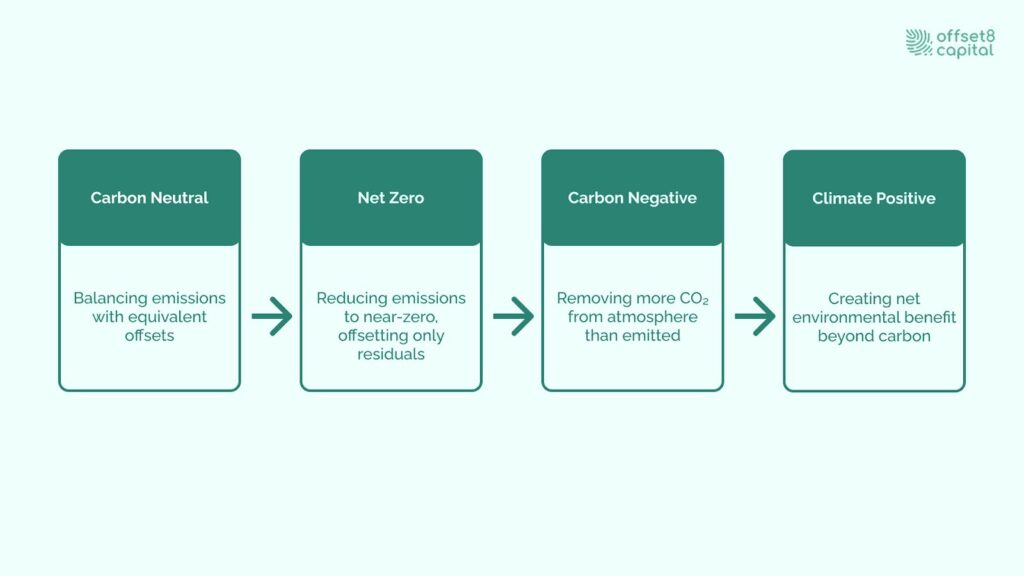

The progression from carbon neutral and carbon negative to climate positive represents distinct milestones in corporate environmental strategy. Carbon credits serve as essential instruments in this progression, helping companies tackle unavoidable emissions today while building lasting strengths in carbon reduction.

By utilizing advanced carbon removal technologies or purchasing carbon removal credits that exceed their emissions, organizations can go beyond achieving carbon neutrality and actively create net-negative emissions, effectively reducing more carbon than they emit. Companies working towards carbon neutrality often discover that carbon negative strategies offer superior long-term value creation.

Achieving institutional-grade carbon negative goals calls for bold, innovative carbon capture and storage solutions that ensure lasting carbon removal from the atmosphere. Advanced carbon credits from nature-based solutions and technology-based solutions provide verified additionality through rigorous due diligence processes. A more proactive environmental approach represents a fundamental shift in how institutional investors approach climate finance.

Fig 1: From Carbon Neutral to Climate Positive

Premium carbon removal technologies including biochar production, enhanced weathering, and direct air capture offer scalable pathways to achieve carbon negative. These solutions undergo comprehensive verification through international standards like the Verified Carbon Standard (VCS) and Gold Standard, providing institutional investors with transparent, compliance-ready investment vehicles that support limiting global warming to 1.5°C as recommended by the Intergovernmental Panel on Climate Change (IPPC).

| Approach | Definition | Key Technologies/Methods |

| Carbon Neutral | Balancing emissions with equivalent offsets | Carbon creditsRenewable energy certificatesTraditional offsetting |

| Net Zero | Reducing emissions to near-zero, offsetting only residuals | Deep emission reductionsEnergy efficiencyRenewable energy transition |

| Carbon Negative | Removing more CO₂ from atmosphere than emitted | Direct air capture (DAC)Biochar productionEnhanced weatheringReforestation with permanenceNature-based solutions |

| Climate Positive | Creating net environmental benefit beyond carbon | Beyond carbon focus – ecosystem restoration |

Tab1: Carbon and Climate Approaches: Definitions, Key Technologies, and Methods

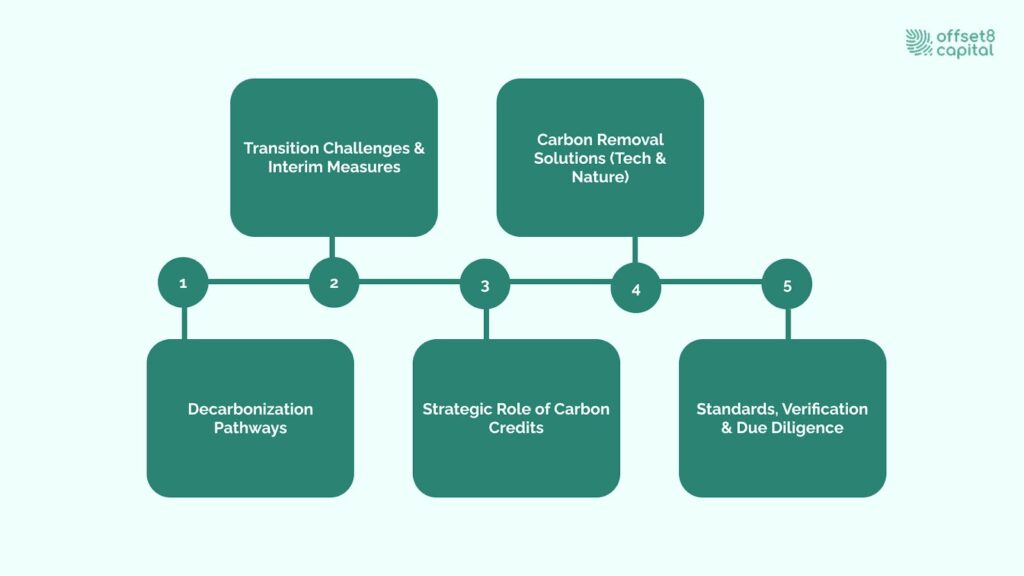

Institutional investors seeking carbon-negative portfolios can follow a structured approach that reduces global carbon emissions while maximizing both environmental impact and financial returns.

The first step is to identify and support companies that are actively addressing the root causes of their carbon emissions, since improving emission sources is the most important and durable environmental measure. For investors, understanding where each potential investee stands on its decarbonization journey is critical to assessing long-term value. Significant emission reductions, however, require time and substantial investment and cannot be achieved overnight.

During this transition, companies need complementary measures to manage the emissions that remain. Institutional investors should therefore evaluate whether portfolio companies are developing credible interim strategies and allocating sufficient resources to meet their carbon-negative targets.

This is where carbon credits play a strategic role. They allow companies to compensate for unavoidable emissions both during the development phase and even after operational improvements have been made. Carbon credits generally fall into two main categories. Technological solutions, such as direct air capture (DAC).

Nature-based solutions, such as reforestation and biochar, leverage natural processes to absorb and store carbon. These solutions contribute to carbon sequestration and can play a significant role in carbon removal efforts, as well as help achieve negative emissions by removing excess carbon dioxide from the atmosphere.

Regardless of the approach, institutional investors need to verify the reliability of every credit in their portfolios. Careful due diligence should confirm that each project meets internationally recognized standards such as Article 6 of the Paris Agreement, Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), and EU Carbon Border Adjustment Mechanism (CBAM).

By focusing on both a company’s position on the decarbonization pathway and the integrity of the credits it relies on, investors can deliver genuine environmental impact while making steady progress toward long-term decarbonization goals and helping the company reach net zero. This approach aligns with the global effort of reducing global carbon emissions and combating climate change.

Fig 2: Five Steps Toward Institutional Carbon Negative

Nature-based solutions open the door to meaningful investments that push us closer to carbon negative in emerging markets. Beyond verified carbon removal, these projects help restore ecosystems, support local communities, and protect biodiversity.

Reforestation initiatives across Africa and Southeast Asia demonstrate how natural carbon sinks can achieve scale while supporting local economies. Biochar production transforms agricultural residues into stable carbon storage, locking atmospheric carbon dioxide for centuries while improving soil health.

When nature-based solutions are paired with smart monitoring tools, everyone gains clear insight into how projects are performing. This integration builds trust, ensures accountability, and shows in real time the positive impact being made.

Satellite verification, blockchain-based tracking, and real-time data analytics provide institutional investors with unprecedented visibility into carbon removal performance and the amount of carbon emitted versus removed.

Leading corporations demonstrate that carbon negative commitments drive both environmental impact and shareholder value in the fight against climate change.

Thorough checks and clear standards make sure carbon negative investments create real climate impact — while still protecting the trust and responsibilities investors hold. Institutional investors evaluate permanence, additionality, and leakage risks through comprehensive assessment protocols.

Verification standards from organizations like Verra and Gold Standard offer third-party validation of carbon removal claims, ensuring the integrity of carbon credits. While their role is crucial in confirming the credibility of these credits, they do not directly drive net-zero outcomes, which are part of a broader strategy.

Risk mitigation strategies for carbon negative investments include:

The evolution of carbon markets toward greater standardization reduces investment uncertainty while improving price discovery for high-quality carbon removal projects.

International policy frameworks create essential infrastructure for carbon negative investments through standardized mechanisms and compliance pathways. Article 6 of the Paris Agreement enables country-to-country transfers of carbon credits. CORSIA requirements for aviation create demand for verified carbon negative solutions, while the CBAM incentivizes investments in genuine carbon removal rather than temporary offsets.

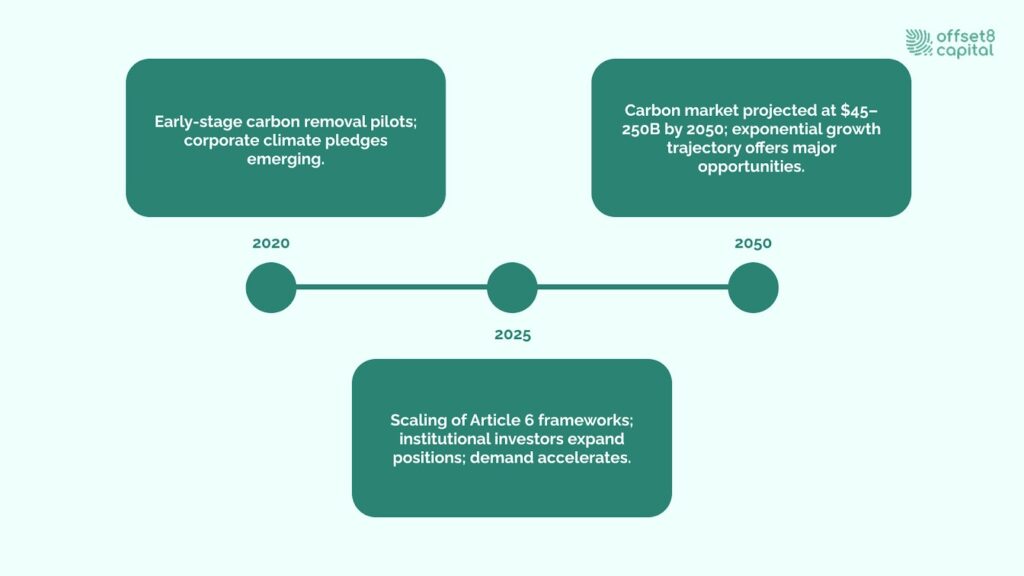

The carbon negative market demonstrates exponential growth potential as institutional investors recognize the convergence of climate necessity and financial opportunity. Market analysis indicates that the carbon market could grow to $45–250 billion by 2050. This growth trajectory creates compelling opportunities for early movers in institutional carbon negative investment strategies.

Fig 4: Carbon Negative Investment Market Outlook (2020–2050)

Carbon negative is at the forefront of climate finance, combining investment strategies that yield both environmental impact and competitive returns. Achieving carbon negative status requires expertise in scientific processes, policy, and market dynamics.

Offset8 Capital, the first regulated carbon fund in the Middle East, offers carbon credits aligned with Article 6 and CORSIA. We focus on nature-based solutions and innovative structures that provide ESG portfolio managers with transparent, compliant, and impactful investment opportunities in Africa and Southeast Asia.

Investors should evaluate permanence of carbon removal, additionality beyond baseline scenarios, third-party verification through recognized standards, and alignment with Article 6 and CORSIA requirements for regulatory compliance.

Verification requires comprehensive monitoring through satellite data, blockchain-based tracking systems, regular third-party audits, and transparent reporting against science-based targets using internationally recognized protocols.

Critical considerations include host country authorization under Article 6, corresponding adjustment mechanisms preventing double-counting, local regulatory alignment, and sustainable development co-benefits ensuring long-term project viability.