Carbon Tax South Africa: Market Overview, Phase 2 Changes, Emissions, NDC & Opportunities

South Africa is entering a decisive stage in its carbon pricing transition. After several years of operating a transitional carbon tax with generous allowances, the country is now preparing for a far stricter Phase 2 from 2026. The new framework combines rising carbon tax rates, declining tax-free allowances and the introduction of mandatory carbon budgets, marking a clear shift toward a fully operational carbon pricing system. As a result, companies will face increasing carbon-cost exposure, while investors and project developers may find growing opportunities in high-quality offsets and decarbonisation solutions.

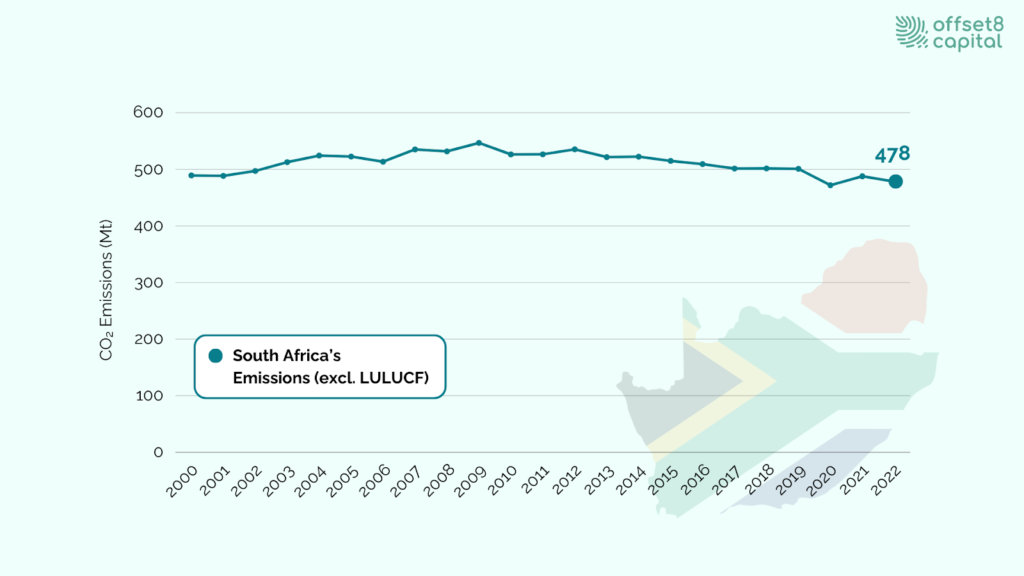

Fig1: South Africa’s Emissions (incl. LULUCF)

According to the National GHG Inventory Report 2022, South Africa’s total greenhouse gas emissions in 2022 (excluding LULUCF) are estimated at 478 MtCO₂e. This represents a 6.44 MtCO₂e increase from 2020, indicating that national emissions have remained within a relatively stable range in recent years.

One of the most notable characteristics of South Africa’s emissions profile is the consistent dominance of the energy sector, which has accounted for approximately 78–79% of national emissions for more than two decades (2000–2022). This long-standing pattern reflects the country’s structural reliance on coal-based power generation and energy-intensive industrial activity.

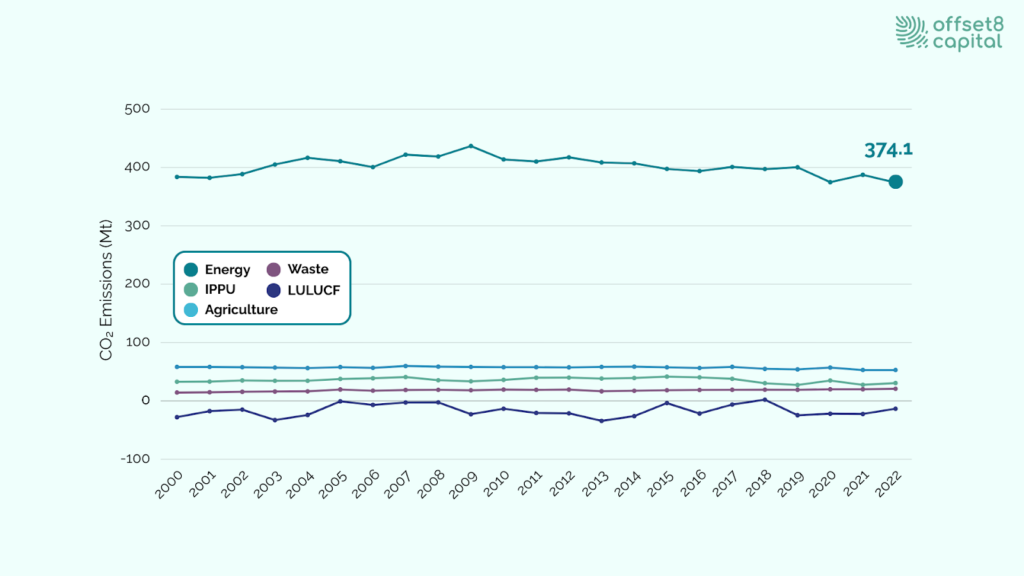

Fig 2: South Africa’s Emissions (Energy / IPPU / Agriculture / LULUCF / Waste)

These figures illustrate that emissions from electricity generation (predominantly coal), industrial combustion, and transport fuel use remain the central drivers of South Africa’s GHG profile. By contrast, agriculture, waste, and other sectors represent a much smaller share of total emissions.

In its second Nationally Determined Contribution (NDC), South Africa sets a new mitigation target for the 2031–2035 period, committing to keep national greenhouse gas emissions within 320–380 MtCO₂-eq by 2035. This represents a clear progression from the updated 2021 NDC.

South Africa will continue its established accounting approach in which emissions from natural disturbances are excluded from the assessment of NDC progress.

Due to the high year-to-year variability in the land sector, this methodology may reduce the accounted emissions in the target year by 5–30 MtCO₂-eq. The government argues that this approach provides a more realistic basis for evaluating policy-driven mitigation progress.

South Africa’s second NDC strengthens its content by incorporating the findings of GST1. GST1 reported that approximately 80% of the global carbon budget consistent with a 1.5°C pathway has already been consumed, underscoring the need for more effective climate action across countries. In light of this, South Africa emphasizes the importance of advancing mitigation efforts in a fair manner, taking into account historical emissions and the differing national circumstances of each country.

South Africa also notes that when translating the global mitigation pathways presented in IPCC AR6 into national targets, it is essential to consider timeframes, regional contexts, and equity-related factors. For this reason, the country expects that international dialogue on developing transparent and widely shared equity indicators will continue to progress, building on GST’s technical discussions. These perspectives are consistent with South Africa’s long-standing positions in UNFCCC negotiations, which are grounded in equity and the principle of Common but Differentiated Responsibilities and Respective Capabilities (CBDR-RC).

South Africa’s second NDC is strongly aligned with the country’s Long-Term Low Emissions Development Strategy (LT-LEDS), which formally commits the nation to achieving net-zero CO₂ emissions by 2050, with the South Africa carbon tax policy serving as a key economic mechanism for this transition.The 2035 mitigation target range (320–380 MtCO₂e) serves as an essential milestone on this long-term pathway and provides a near-term anchor for planning and implementation. Key energy-sector strategies guiding this transition include:

Together, these policies are intended not only to reduce emissions but also to advance green industrialization, enhance energy security, and lay the foundation for a climate-resilient, low-emission economy.

South Africa situates its 2031–2035 NDC firmly within a comprehensive Just Transition framework, reflecting the understanding that decarbonization in a coal-dependent economy is not only a technological shift but a social and economic transformation.

Recognizing the country’s national circumstances, including dependence on coal for both employment and electricity, the Just Transition aims to ensure that the shift to a low-emission economy is fair, inclusive, and socially protective. Central priorities include:

Central priorities include:

This approach also integrates broader structural transformation: diversifying the economy away from fossil-fuel dependence, developing green value chains (including critical transition minerals), and building competitiveness in a future low-carbon global economy.

South Africa emphasizes that mitigation ambition and social justice must advance together. Very rapid or unmanaged transitions, as noted in GST1, could create severe socio-economic disruptions. Therefore, the country aims to pursue structural change in a just, orderly, and equitable manner, accelerating mitigation while ensuring poverty reduction, employment creation, and affordable energy.

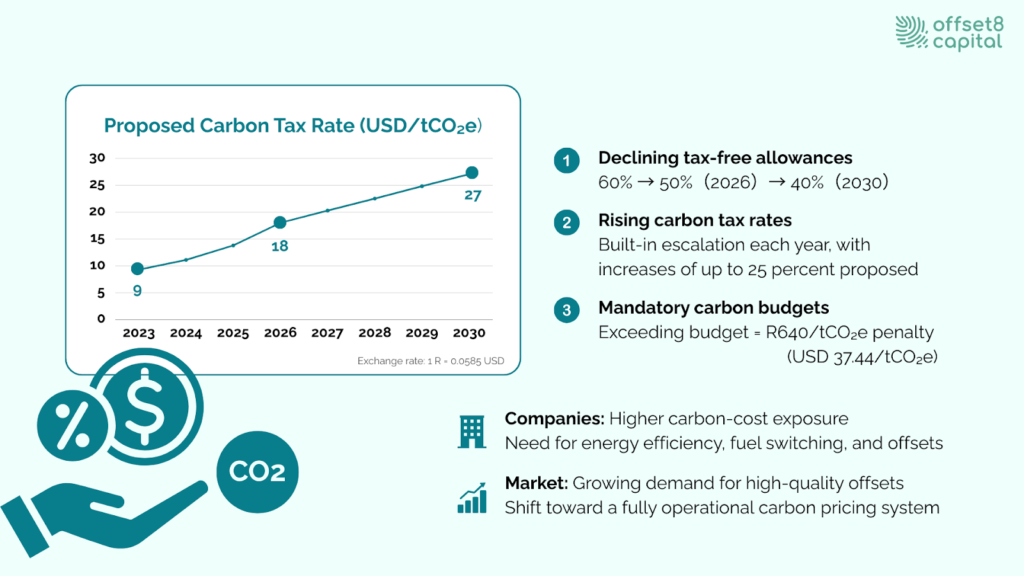

Fig 3: South Africa’s Carbon Tax Phase 2: Rising Costs and Stronger Compliance Signals

South Africa’s carbon tax system operates differently from the simple “emissions × tax rate” model used in many countries. Instead, the tax is applied after subtracting several Tax-Free Allowances, meaning the effective carbon price that companies face depends heavily on how these allowances are structured. As a result, understanding the tax requires focusing not only on statutory rates but also on the design of these allowances.

Furthermore, South Africa’s statutory carbon tax rate has already been rising rapidly. The carbon tax increased from R159/tCO₂ (approximately USD 9.3) in 2023 and is expected to reach R462/tCO₂ (around USD 27) by 2030, following a built-in schedule of annual increases.

| Year | Carbon Tax (R/tCo2) | USD |

| 2023 | 159 | 9.30 |

| 2024 | 190 | 11.12 |

| 2025 | 236 | 13.81 |

| 2026 | 308 | 18.02 |

| 2027 | 347 | 20.29 |

| 2028 | 385 | 22.53 |

| 2029 | 424 | 24.83 |

| 2030 | 462 | 27.06 |

Table 1 : South Africa’s carbon tax rates (Exchange rate: 1 R = 0.0585 USD)

During Phase 1, South Africa intentionally limited industry impacts by introducing generous transitional measures. Companies could combine several allowances:

In practice, some entities received up to 95% tax-free treatment, meaning the carbon tax burden remained very limited during the introduction period.

Revenue recycling also softened impacts: tax income was channelled into electricity price relief credits, renewable energy support, and energy efficiency incentives. In addition, generators were prohibited from passing the carbon tax through to electricity tariffs during Phase 1, reinforcing the system’s role as a preparatory stage for industry.

The carbon tax South Africa implements in Phase 2 marks a fundamental redesign of the system. Two changes are particularly significant: a sharp reduction in tax-free allowances, and a substantial carbon tax increase.

A binding carbon budget will apply to major emitters. Exceeding the assigned budget will trigger a penalty rate of R640/tCO₂e, creating one of the strongest compliance signals in the regime.

The gradual withdrawal of Phase 1’s generous allowances, combined with higher tax rates and strict carbon budgets, means companies will no longer be insulated from carbon costs. Firms will need to invest strategically in:

Phase 2 therefore represents South Africa’s transition from an introductory framework to a fully operational carbon pricing mechanism, aligned with national climate commitments and the pathway toward net-zero.

| Year | Basic | Carbon offset | Performance | Trade exposure | Carbon Budget | Max Allowance |

| 2025 | 60 | 10 | 5 | 5 | 5 | 85 |

| 2026 | 50 | 25 | 10 | 0 | 0 | 85 |

| 2027 | 47.5 | 25 | 10 | 0 | 0 | 82.5 |

| 2028 | 45 | 25 | 10 | 0 | 0 | 80 |

| 2029 | 42.5 | 25 | 10 | 0 | 0 | 77.5 |

| 2030 | 40 | 25 | 10 | 0 | 0 | 75 |

| 2031 | 37.5 | 25 | 10 | 0 | 0 | 72.5 |

| 2032 | 35 | 25 | 10 | 0 | 0 | 70 |

| 2033 | 32.5 | 25 | 10 | 0 | 0 | 67.5 |

| 2034 | 30 | 25 | 10 | 0 | 0 | 65 |

| 2035 | 27.5 | 25 | 10 | 0 | 0 | 62.5 |

Table 2: Proposed Phase 2 Tax-Free Allowance Schedule under South Africa’s Carbon Tax (%)

South Africa’s carbon market is entering a major turning point as the carbon tax becomes more stringent. Under Phase 2 of the carbon tax system (2026–2030), companies will be able to use significantly higher offset allowances, making carbon credits an increasingly important cost-management tool.

According to the Phase 2 proposals, companies may offset:

This structure creates strong incentives for companies to purchase offsets to lower their effective tax liability, and is expected to drive a sharp increase in domestic offset demand over the coming years.

The South Africa carbon offset market operates under Carbon Offset Administration System (COAS), the official government-managed registry which already lists more than 22 million tCO₂e in registered credits.

However, the composition of these projects is heavily skewed toward technology-based activities. In contrast, although AFOLU (forestry and agriculture) projects are formally eligible under the regulations, very few such projects have been approved in practice.

| Project categories | Number of Projects |

| Waste handling and disposal | 14 |

| Energy industries | 10 |

| Chemical industries | 9 |

| Energy demand | 3 |

| Manufacturing industries | 2 |

| Metal production | 1 |

| Total | 39 |

Table3: South Africa Approved Carbon Offset Projects 2024

Under the 2019 Carbon Offset Regulations, South Africa formally recognizes carbon offset projects that are developed under the following international crediting standards for use in reducing domestic carbon tax liability.

These standards apply strict requirements for additionality, MRV which refers to measurement, reporting and verification, and environmental integrity. The South African government officially acknowledges them as eligible compliance grade offsets.

The Carbon Offset Regulations also allow the Minister responsible for Energy or a delegated authority to approve other crediting standards. This means that these three international standards are not the only possible options within the regulatory framework.

With the expansion of offset usage limits in Phase 2 of the carbon tax, credits issued under these internationally recognized standards are widely expected to make up a significant portion of the supply available to the South African compliance offset market.

Under Phase 2 of the carbon tax, South African companies are expected to face continued upward pressure on carbon pricing costs. As tax rates rise and allowance levels gradually decline, high-emitting firms may experience more substantial cost increases. This is likely to drive greater investment in emission reduction measures, including equipment upgrades, renewable energy deployment and improvements in energy efficiency.

Some analyses indicate that these shifts may increase employment risks, often referred to as job risk, in carbon-intensive sectors. At the same time, the South African government continues to emphasize a Just Transition approach that aims to balance industrial restructuring with employment protection.

A strengthened carbon tax framework may also accelerate the use of carbon offsets, contributing to what appears to be a growing domestic offset market. Companies may increase their credit purchases to more effectively manage tax liabilities, and international buyers may also show heightened interest in South African credits. These developments could enhance the country’s attractiveness as a destination for climate-related investment.

At present, South Africa’s offset landscape is dominated by industrial, waste and energy-related projects, such as nitrous oxide abatement, landfill gas and waste management initiatives. This composition may create early advantages for investors focusing on these segments.

Phase 2 is also expected to increase the allowable use of offsets, which could create additional opportunities for project developers. Sectors such as renewable energy, energy efficiency, low-carbon transport and nature-based solutions may see improved project economics and attract both domestic and international capital.

While rising carbon tax costs are likely to influence corporate operational and investment decisions, these changes may simultaneously open pathways for new market opportunities. South Africa’s carbon market appears to be entering a transitional phase that could become increasingly important for both corporate strategy and investor engagement.

FAQ

From 2026, carbon tax rates will rise, tax-free allowances will be reduced, and binding carbon budgets will be introduced. While Phase 1 allows up to 95% tax-free treatment, Phase 2 will significantly increase the effective carbon cost for companies.

Yes. Offsets become more important under Phase 2. Companies may offset up to 25% of combustion emissions and 20% of process emissions, making carbon credits a key cost-management tool.

The market will remain compliance-driven while attracting growing interest from international investors. Clearer carbon pricing signals are expected to support decarbonisation investment and market development.

Companies subject to the carbon tax South Africa system can access offsets through the Carbon Offset Administration System (COAS). Eligible projects must be certified under government-approved standards: CDM (Clean Development Mechanism), Verra's VCS, or Gold Standard. Under Phase 2, companies may offset up to 25% of combustion emissions and 20% of process emissions, making the South Africa carbon market a key tool for managing tax liabilities.