The International Civil Aviation Organization (ICAO) has released a new set of regulations for the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) as the scheme enters Phase 2. Designed to curb CO₂ emissions from international aviation, CORSIA has now become a central pillar of the sector’s decarbonization efforts. With a record number of States reporting verified CO₂ emissions under CORSIA, alongside rising emissions, revised eligibility criteria for carbon credits, and newly issued guidance on Sustainable Aviation Fuels (SAF), 2025 is shaping up to be a pivotal year that will define the future of CORSIA.

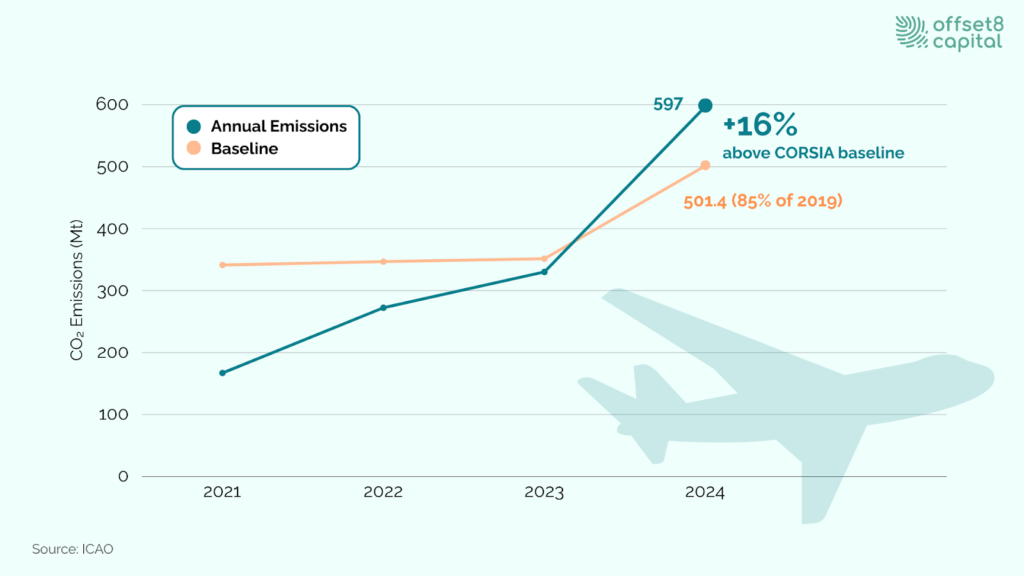

In 2024, a total of 128 States submitted verified CO₂ emissions, marking the highest participation rate since the scheme began. According to ICAO, international aviation emitted 597 million tonnes of CO₂ in 2024, representing a 12.6 percent increase compared to 2023. Much of this growth reflects the strong post-pandemic rebound in international air travel, which in turn directly raises airlines’ offsetting obligations under CORSIA.

To ensure completeness of the dataset, ICAO supplemented the data for 10 States that did not submit reports and calculated the Sectoral Growth Factor (SGF) for 2024 based on a fully consolidated dataset.

ICAO uses the CORSIA Annual Sector Growth Factor (SGF) as an indicator of how much international aviation emissions exceed the scheme’s baseline. Using the verified CO₂ data for 2024 and 85 percent of 2019 emissions as the CORSIA baseline, ICAO released the 2024 SGF at 0.15948 (or 15.95 percent) in late 2025. This positive SGF indicates that sector-wide emissions have exceeded the baseline, triggering measurable offsetting obligations for airlines under CORSIA’s first phase.

In the following section, we take a closer look at how emissions are calculated under CORSIA and how the SGF functions within this framework.

CORSIA Calculation Steps

Fig1: How CORSIA Calculates Offsetting Obligations

CORSIA calculates international aviation emissions through a three step process.

The SGF indicates how much the sector’s emissions in a given year exceed the baseline year (2019). The formula is as follows:

SGF= Emissions in the given year− Baseline Year Emissions*/ Sector emissions in the given year

For example, if emissions in year X are 1,000 and baseline emissions are 900, then:

(1,000 − 900) / 1,000 = 0.1

This means emissions have increased by 10 % compared to the baseline year.

*Here, the term “emissions” refers not to the emissions of individual airlines, but to the total emissions from all State Pairs covered under CORSIA. Examples include all eligible international routes such as Japan to the United States, Japan to Thailand, and the United Arab Emirates to Japan.

Fig2: CORSIA Annual Sector Growth Factor (SGF) trend analysis

From 2022 to 2024, the SGF values announced for emissions from 2021 to 2023 remained at zero. This was because total emissions in those years stayed below the 2019 baseline, largely due to the significant decline in international aviation activity caused by COVID-19. As a result, airlines faced no offsetting obligations during this period, which effectively served as a preparation phase.

The situation changed in 2024. For that year’s SGF calculation, ICAO introduced a stricter baseline defined as 85 percent of 2019 emissions. Combined with the strong post pandemic recovery in international air travel, actual emissions exceeded this adjusted baseline by a wide margin, resulting in an SGF of 0.15948315, or approximately 15.94 percent.

This means that airlines are required to offset about 15.95% of their 2024 emissions through the use of Sustainable Aviation Fuels or CORSIA Eligible Emissions Units. For the first time since the scheme’s launch, CORSIA has transitioned into a fully operational compliance mechanism that imposes clear financial obligations and strategic decision making on airlines.

CORSIA Eligible Fuels (CEF) are aviation fuels that meet the sustainability criteria and life-cycle greenhouse gas (GHG) emissions requirements established under the CORSIA. Not all SAF qualifies as CEF. Only fuels that satisfy strict criteria on sustainability, LCA methodology, and supply chain traceability are recognized as CEF under the scheme.

Airlines must monitor the amount of CO₂ reduced through the use of CEF and include the required information in an appendix to their emissions report, as specified in Annex 16, Volume IV. These data must then be verified by an accredited verification body. Airlines may choose when to claim CEF reductions, either annually, every two years, or in a single submission at the end of the compliance cycle.

Under CORSIA, the use of CEF functions as a direct deduction. One tonne of CEF based emission reductions lowers the offsetting requirement by one tonne. In other words, the offsetting obligation calculated as emissions multiplied by the SGF can be reduced by subtracting the verified CEF reductions.

Example:

SGF: 0.1

Own emissions: 1,000 tCO₂

CEF reductions: 10 tCO₂

Calculation:

(1,000 × 0.1) − 10 = 90

In this case, the airline must offset 90 tCO₂ with CORSIA eligible credits.

SAF alone cannot meet the obligation: credit demand remains unavoidable in the near term

Although SAF deployment is gradually increasing, IATA estimates show that SAF accounted for only 0.2% of global aviation fuel use in 2023, 0.3% in 2024, and is expected to reach only 0.7 percent in 2025. This demonstrates that SAF remains a very small fraction of total fuel consumption and that current production capacity is far below projected demand.

Because of this, credit purchases are unavoidable in the short to medium term. Airlines have entered a phase where developing a robust CORISA credit procurement strategy is essential. At the same time, the eligibility rules for CORSIA compliant credits have become more stringent and the supply of credits that meet these criteria is limited. As a result, credit prices have risen rapidly due to tightening supply and demand conditions, making early procurement increasingly important.

One of the most significant developments in 2025 is ICAO’s formal confirmation of the crediting programs that can be used under CORSIA Phase 2, which covers 2027 to 2029. At the ICAO Council meeting in October 2025, only the following four programs were approved:

For the compliance period covering 2024 to 2026, which corresponds to Phase1 of CORSIA, the Council approved two additional programs. This brings the total number of eligible programs for Phase1 to 8. ICAO is also continuing its efforts to expand credit supply for Phase1. The Technical Advisory Body is reviewing material changes submitted by three programs, BioCarbon Fund, Forest Carbon Partnership Facility, and Global Carbon Council. Whether these programs will be added as eligible programs will be decided at the Council session in March 2026. The Paris Agreement Crediting Mechanism is also expected to undergo an eligibility assessment once it becomes operational.

In early 2026, a new TAB application cycle will begin for the purpose of approving additional programs for Phase 2. Programs that pass this review may also become retroactively eligible for Phase 1, which could expand the supply of compliant credits available to airlines.

| Programme | Pilot Phase(2021–2023) | First Phase(2024–2026) | Second Phase(2027–2029) |

| Gold Standard (GS) | 2016–2023 units | 2021–2026 units | 2021–2029 units |

| Verra VCS / Jurisdictional Nested REDD+ | 2016–2023 units | 2021–2026 units | 2021–2029 units |

| American Carbon Registry (ACR) | 2016–2023 units | 2021–2026 units | 2021–2029 units |

| Architecture for REDD+ Transactions (ART) | 2016–2023 units | 2021–2026 units | 2021–2029 units |

| Climate Action Reserve (CAR) | 2016–2023 units | 2021–2026 units | — |

| Global Carbon Council (GCC) | 2016–2020 units | 2021–2026 units | — |

| Isometric | — | 2021–2026 units | — |

| Thailand Voluntary Emission Reduction Programme | — | 2021–2026 units | — |

| Forest Carbon Partnership Facility (FCPF) | 2016–2020 units | Conditionally eligible | — |

| BioCarbon Fund for Sustainable Forest Landscapes | 2016–2020 units | Conditionally eligible | — |

| Cercarbono | — | Conditionally eligible | — |

| China Certified Emission Reduction (CCER) | 2016–2020 units | — | — |

| Clean Development Mechanism (CDM) | 2016–2020 units | — | — |

| SOCIALCARBON | 2016–2020 units | — | — |

| Joint Crediting Mechanism (Japan–Mongolia) | Conditionally eligible | — | — |

Table1: CORSIA Eligibility of Crediting Programmes by Phase

Alongside the tightening of credit eligibility rules, ICAO has accelerated its policy focus on Sustainable Aviation Fuels. In 2025, ICAO launched a new official dashboard for CORSIA Eligible Fuels. Based on annual reports submitted by ICAO approved Sustainability Certification Schemes for the years 2022 to 2024, this dashboard provides consolidated information on certified entities, fuel batches, feedstock categories, life cycle assessment values, and approved production pathways. This system enables airlines to calculate their CEF claims under CORSIA with greater accuracy.

SAF plays a particularly important role in CORSIA because its impact is reflected as a direct reduction in compliance obligations. Using one tonne of CORSIA eligible SAF reduces an airline’s offsetting requirement by one tonne. ICAO also plans to approve new feedstock specific life cycle assessment values at the November 2025 Council session, following the request made at CAAF/3. This will expand the number of SAF pathways eligible under CORSIA.

A Major Development in Asia: The ClassNK Certification Scheme

Amid these global developments, an important announcement emerged from Asia. In October 2024, ClassNK, the ship classification society of Japan, received ICAO Council approval for the ClassNK Sustainability Certification Scheme. This made it the first ICAO approved SAF sustainability certification scheme in Asia. Previously, ICAO had approved only two European schemes, meaning that Japanese SAF producers had to rely solely on foreign certification bodies.

ClassNK SCS entered full operation in August 2025 following the completion of domestic institutional arrangements. As a result, SAF producers in Japan can now obtain certification as CORSIA eligible SAF from organizations that understand Japan’s regulatory framework and industrial practices. Specifically, the Japan Accreditation Board serves as the accreditation body and the Nippon Kaiji Kentei Quality Assurance Ltd. has begun certification activities, establishing a complete domestic certification pathway.

This development provides essential support for Japan’s rapidly expanding SAF supply chain. Japan has set a target of replacing 10% of aviation fuel used by domestic airlines with SAF by 2030. Domestic SAF production is expected to increase from approximately 20,000 kiloliters in 2025 to about 1.92 million kiloliters in 2030. With the launch of the ClassNK SCS, Japan has strengthened its certification infrastructure and is expected to become an increasingly important supply hub within the global SAF ecosystem.

Fig3: Key Actions for Airlines Under CORSIA Phase 1

With CORSIA Phase 1 (2024-2026) now fully underway and the Sector Growth Factor (SGF) turning positive for the first time in 2024, airlines in States that have voluntarily opted into Phase 1 have entered the initial stage of real and enforceable compliance obligations. As offsetting requirements begin to materialize and both SAF policies and credit eligibility rules tighten simultaneously, airlines must respond in a more strategic manner and with stronger long-term planning.

The first priority is to estimate the airline’s total compliance obligation. Using the 2024 SGF of 0.15948315, airlines should project their emissions, determine the amount of SAF or credits required, and evaluate the financial impacts.

The timing of CEF claims, whether submitted annually, biennially, or at the end of the compliance cycle, significantly affects the final obligation. These calculations require technical expertise, which makes early establishment of a robust MRV system essential.

CORSIA eligible SAF provides a direct compliance benefit because each tonne used reduces the offsetting requirement by the same amount. However, global SAF supply remains extremely limited, representing only about 0.3% of total jet fuel consumption.

Airlines that secure multiyear offtake contracts early will hold a clear advantage. Strategic investments that anticipate future SAF supply expansion will become increasingly important.

High quality credit procurement remains indispensable. ICAO has reduced eligible programs for Phase 2 from 8 to 4 and strengthened environmental integrity requirements. This tightening is expected to restrict supply further and may lead to higher prices and lower liquidity.

Many airlines are already locking in credits through long term agreements and exploring hedging strategies to manage future price risks.

CORSIA requires formal host country Authorization for credits used in compliance to avoid double counting. To ensure stable access to eligible credits, it can be highly beneficial for airlines to work with suppliers and investment firms that implement rigorous due-diligence processes, maintain strong government relationships, and offer insurance and other risk-mitigation mechanisms to address authorization, eligibility, and sovereign risk.

FAQ

CORSIA eligible credits must satisfy three conditions: they must be issued under an ICAO approved crediting program, accompanied by a formal host country Letter of Authorization, and subject to a corresponding adjustment. They must also comply with detailed program specific rules. These standards are significantly more stringent than those applied in the voluntary carbon market, which means that not all VCM credits can be used for CORSIA compliance.

Because of CORSIA’s strict eligibility rules, only a limited supply of credits worldwide meets the required criteria. At the same time, demand is rising rapidly as ICAO strengthens compliance obligations for the aviation sector. This imbalance is pushing prices upward and is expected to continue to do so.

The sooner the better. Both SAF and CORSIA eligible credits have limited supply, and competition for future supply is increasing quickly. Early action allows airlines to secure access, stabilise costs, and avoid future compliance risks.

ICAO's October 2025 decision reduced eligible programs from eight to four for Phase 2 (2027-2029). Only Gold Standard, Verra VCS, ACR, and ART were approved. Climate Action Reserve, Global Carbon Council, Isometric, and Thailand VERP are excluded from Phase 2 but remain valid for Phase 1.