Indonesia's carbon market represents one of the world's most promising opportunities for generating carbon credits, thanks to its vast tropical forests, extensive peatlands and rice paddies. These ecosystems act as powerful carbon sinks and can deliver large emission reductions when properly managed.

Beyond its natural advantages, the government of Indonesia is proactively engaging in key international frameworks such as the Paris Agreement, Article 6 mechanisms and CORSIA. Indonesia recently entered into agreements with major carbon standard setters like Verra and Gold Standard in May and October 2025, respectively, and is set to do the same with the Global Carbon Council in September 2025, to align its carbon market with international standards and facilitate foreign investment for its climate goals. These Mutual Recognition Agreements (MRAs) allow projects certified under these international programs to be recognized in Indonesia's national registry, enhancing the integrity and accessibility of its carbon market to global buyers and boosting climate finance. In September 2022 the country announced an enhanced NDC committing to cut emissions by 31.89 percent by 2030 and up to 43.2 percent with international support, while pledging to reach net zero by 2060. Indonesia has also confirmed participation in CORSIA starting January 2026, positioning itself to meet the rising demand for high quality aviation offsets. These factors make Indonesia not merely an emitter but an increasingly important global supplier of verified carbon credits, strengthening its role as a key player in international carbon markets. Under President of Indonesia Prabowo Subianto's administration, the country is building upon Joko Widodo's foundation to develop a green economy focused on sustainable development.

Indonesia carbon market development is supported by a set of laws and regulations that were introduced step by step to build credibility and stability.

The Presidential Regulation No. 98 of 2021 established the Carbon Economic Value (Nilai Ekonomi Karbon, NEK) framework. It positions greenhouse gas reduction, climate adaptation, transparency, and a system for monitoring, reporting and verification (MRV) as national policy. This regulation authorizes several mechanisms, including carbon trading, results-based payment, and a carbon levy or tax, which can be adopted as technology and market conditions evolve.

The Ministry of Environment and Forestry Regulation No. 21 of 2022 provides the detailed procedures for implementing the NEK. It explicitly allows both domestic and international carbon trading as well as direct transactions between companies, and it envisions a system that combines emission caps with offset credits.

In 2023, the Law No. 4 of 2023, known as the P2SK Law, strengthened the financial sector and classified carbon credit trading as a type of security. This gave the Financial Services Authority (OJK) clear legal authority to oversee the carbon market in Indonesia. Under this law, the OJK Regulation No. 14 of 2023 sets out requirements for establishing a carbon exchange, defines trading units, and details user registration, trading rules, and settlement procedures. Together, the presidential regulation, ministerial regulation, and financial-sector law create a layered framework that provides the legal foundation, operational guidance, and supervisory structure needed to ensure both the credibility and the stability of Indonesia carbon credit market.

Indonesia operates both an emissions trading system (ETS) and a carbon credit offset scheme, and the government aims to link the two in a hybrid market structure.

Launched in 2023, Indonesia ETS is an intensity-based program focused on the power sector, targeting coal-fired power stations for emission reductions. Each participating coal-fired power plant receives a technology-specific emission cap known as PTBAE-PU. Facilities that emit less than their cap can sell the surplus, while those exceeding it must purchase additional allowances. In its first year, the scheme covered 99 coal-fired plants connected to the PLN grid, representing about 37 percent of total national power capacity and roughly 67.6 percent of coal-fired capacity. The government has indicated that the ETS could eventually be combined with a carbon tax in a “cap-and-tax-and-trade” model, under which entities that fail to meet ETS obligations would pay a tax.

Trading takes place on the Indonesia Carbon Exchange (IDX Carbon), officially opened in September 2023. Operated by the Indonesia Stock Exchange (IDX) and supervised by the Financial Services Authority (OJK), IDX carbon trading platform handles both emission quotas (PTBAE-PU) for the ETS and carbon credits (SPE-GRK) that certify verified emission reductions. These credits can be used to meet a portion of compliance requirements in the power sector’s ETS. Expanding the use of credits across additional sectors will require further regulatory development and detailed implementation rules.

The Indonesian government is actively pursuing international carbon credit transactions under Article 6 of the Paris Agreement. With Singapore, Indonesia signed an intergovernmental Memorandum of Understanding in 2022 covering climate cooperation and carbon pricing, laying the groundwork for Article 6–aligned credit trading.

With Japan, Indonesia partners through the Joint Crediting Mechanism (JCM), which is recognized as consistent with Article 6. Indonesia is among the most active JCM host countries, with one of the highest numbers of registered projects. In January 2025, the Indonesia Carbon Exchange (IDX Carbon) opened trading to international investors for the first time. According to official announcements, the inaugural sessions recorded about one million tonnes of CO₂e in transactions. Looking ahead, the government plans to expand credit generation in the forestry sector. Estimates from the Ministry of Environment and Forestry and the state news agency Antara indicate that forest-related offset transactions could reach as much as 3.2 trillion rupiah (around USD 200 million) in 2025.

These initiatives highlight Indonesia’s intent to become a significant supplier of high-quality credits to global markets while strengthening bilateral and regional climate partnerships through idx carbon market development.

Indonesia’s diverse ecosystems and agricultural landscapes provide multiple pathways for generating high-quality carbon credits. From innovative farming techniques to advanced biomass utilization and the conservation of rich coastal habitats, the country is well positioned to cut emissions and enhance carbon sinks. The following sections highlight three of the most promising approaches: Alternate Wetting and Drying (AWD) in rice cultivation, biochar production and deployment, and the protection and restoration of mangrove forests.

Alternate Wetting and Drying (AWD)

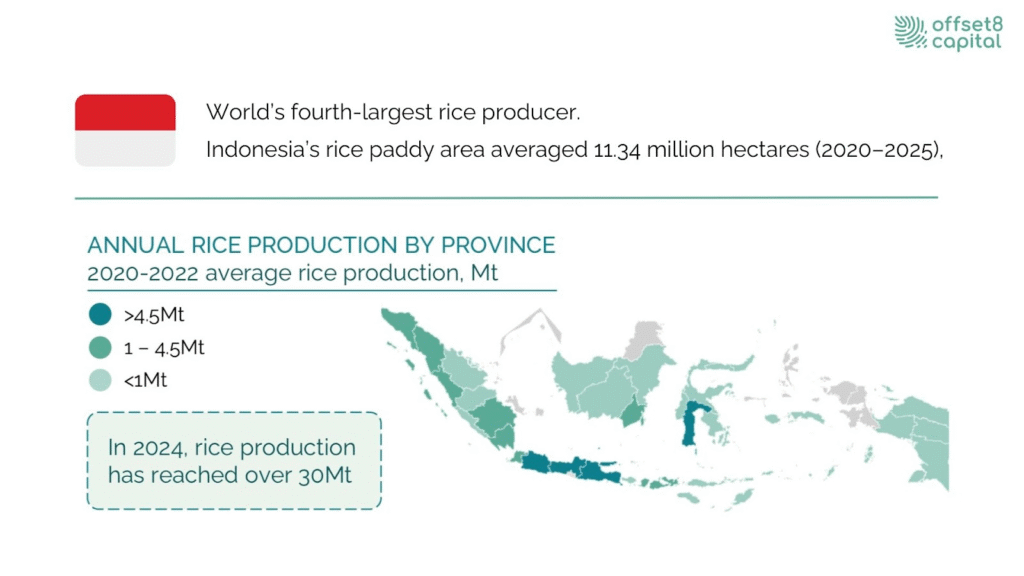

Fig 1: Indonesia’s Rice Production and Paddy Area Overview

In the agricultural sector, Alternate Wetting and Drying (AWD) is a water management practice that can reduce greenhouse gas emissions in rice paddies and offers significant potential in Indonesia. As the world’s fourth largest rice producer, the country maintained an average of about 11.34 million hectares of rice paddies between 2020 and 2025. Applying AWD across these extensive rice fields could provide substantial reductions in greenhouse gas emissions.

Biochar

Biochar is rapidly gaining attention in Indonesia as a promising climate solution. Produced by pyrolyzing agricultural residues or woody biomass under low-oxygen conditions, biochar provides long-term carbon sequestration while improving soil health.

In 2012 a group of environmental advocates, including Hashim Djojohadikusumo, founded the Asosiasi Biochar Indonesia, who is also Indonesia's Special Envoy for Climate and Energy, appointed by President Prabowo Subianto to promote the use of biochar for sustainable agricultural waste management, soil enhancement, and climate change mitigation. CIFOR (the Center for International Forestry Research) has referenced biochar in its research as a potential technology for long-term soil carbon sequestration and agricultural waste management, noting its possible role in agricultural carbon accounting. Among current initiatives, Sawa Ecosolutions stands out as Indonesia’s first and largest commercial biochar project, aiming to remove up to one million tonnes of CO₂ each year. Supported by growing incentives from Indonesia's voluntary carbon market, projects like Sawa are accelerating the large-scale deployment of biochar technologies and strengthening Indonesia’s role in the global carbon market. The project also explores pellet fuel production from agricultural waste, contributing to bioeconomy development.

Pic 1: Hashim Djojohadikusumo, founder of Indonesian Biochar Association and Indonesia's Special Envoy for Climate and Energy at the opening of the Sawa EcoSolutions biochar carbon credit project in Majalengka Regency in West Java, Indonesia.

Mangrove

Along the coasts, Indonesia contains the world’s largest mangrove area of about 3.3 million hectares, making blue carbon projects a major opportunity. A joint report by the Ministry of Environment and Forestry and the World Bank estimates that these mangroves store around 3.1 petagrams (31 billion tonnes) of carbon. With its vast area and exceptional carbon storage capacity, Indonesia can undertake a wide range of projects, from maintaining protected mangrove forests to restoring degraded coastal areas, preventing deforestation and protecting critical habitat for species like orangutan populations.

Indonesia’s carbon market is expected to grow under the combined influence of its domestic ETS and credit systems as well as international climate frameworks.

First, mechanisms such as the Joint Crediting Mechanism (JCM), which already supports many projects, will help expand Indonesia’s carbon credit market through cooperation with other countries.

In addition, the Asia Zero Emission Community (AZEC) functions as a government-to-government platform for collaboration in energy, transport, and industry. Joint statements from leaders highlight the development of carbon markets as a key agenda item.

The ASEAN bloc is also working to create a highly interoperable carbon market. At the 2024 United Nations Climate Change Conference (COP29), member states agreed to advance the ASEAN Common Carbon Framework (ACCF) to support the growth of a shared regional carbon market. These regional initiatives are expected to influence credit supply and price formation across Southeast Asia, addressing global warming potential through coordinated trade mechanisms.These international policy developments will directly shape Indonesia’s carbon market. Going forward, the country is likely to strengthen its market by pursuing active regional cooperation and aligning with global frameworks through voluntary carbon market expansion in Indonesia.

Indonesia is emerging as one of the most strategically positioned countries in the global carbon market. Its vast natural carbon sinks, including tropical forests, mangroves, and rice paddies, provide exceptional potential for generating high quality credits. A comprehensive domestic framework that integrates the ETS, voluntary credits, and strong financial regulation offers a solid foundation for market growth. Regional cooperation through AZEC and ASEAN initiatives, combined with active participation in Article 6 and CORSIA, further strengthens Indonesia’s role.

Disclaimer

This commentary is for informational purposes only and should not be considered financial, investment, or regulatory advice. Offset8 Capital Limited is regulated by the ADGM FSRA (FSP No. 220178). No assurances or guarantees are made regarding its accuracy or completeness. Views expressed are our own and subject to change

Indonesia operates both an Emissions Trading System (ETS) and a carbon credit (offset) scheme. Launched in 2023, the ETS focuses mainly on the power sector, assigning each plant a technology-specific emission cap known as PTBAE-PU. Facilities that emit less than their cap can sell surplus allowances, while those exceeding it must purchase additional units. Both the emission quotas and verified reduction credits (SPE-GRK) are traded on the Indonesia Carbon Exchange (IDX Carbon) under the supervision of the Financial Services Authority (OJK).

Indonesia possesses some of the world’s largest natural carbon sinks, including vast tropical forests, peatlands, mangroves, and rice paddies, giving it exceptionally high potential for greenhouse gas reductions. In addition, the country actively participates in international frameworks such as Article 6 of the Paris Agreement and CORSIA, while also developing a robust domestic ETS and carbon credit system. These factors position Indonesia to supply high-quality carbon credits to the global market.

In Indonesia, there are diverse opportunities in both nature-based and technology-driven projects. Notable examples include Alternate Wetting and Drying (AWD) in rice cultivation to reduce methane emissions, biochar production for long-term carbon sequestration and soil improvement, and blue carbon initiatives that protect and restore the country’s vast mangrove ecosystems, the largest in the world.

Indonesia IDX Carbon officially opened trading to international investors for the first time in January 2025, with inaugural sessions recording about one million tonnes of CO₂e in transactions. The platform is operated by the Indonesia Stock Exchange (IDX) and supervised by the Financial Services Authority, handling both emission quotas (PTBAE-PU) for the domestic ETS and carbon credits (SPE-GRK) that certify verified emission reductions. By the end of 2024, the platform had registered 100 participants as Carbon Exchange Service Users, up from only 16 users at launch.