Climate change is fundamentally reshaping Environmental, Social, Governance materiality assessments (ESG). For institutional investors and corporate leaders, this is no longer a side consideration but a central pillar of strategic decision-making. It has become the bridge between climate risk management and long-term value creation, guiding organizations towards sustainability.

Sustainability frameworks are now investment intelligence tools, enabling investors to anticipate systemic risks, align portfolios with climate priorities, and unlock long-term value through transparency, resilience, and accountability.

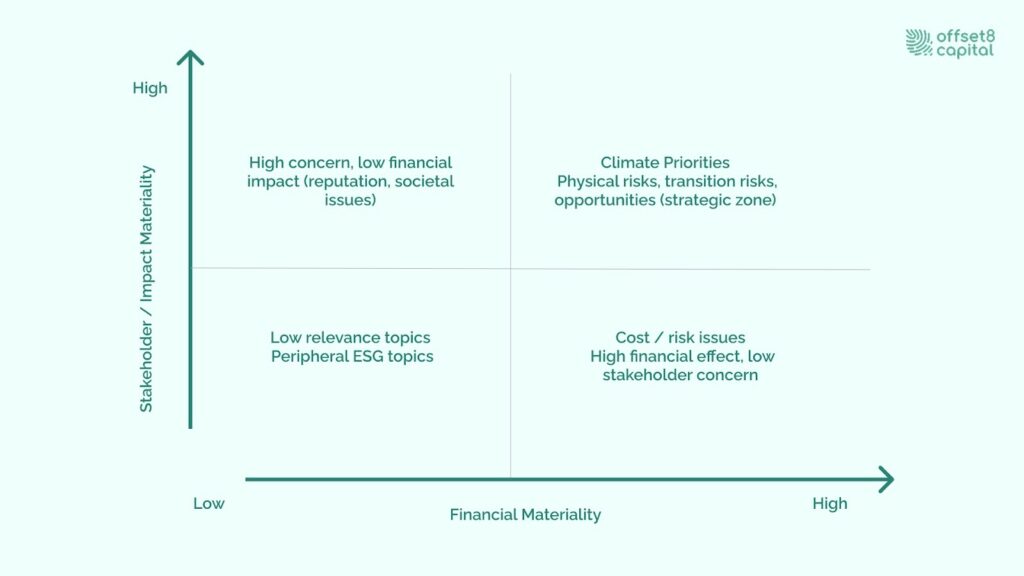

Fig 1: Climate and ESG Materiality Matrix

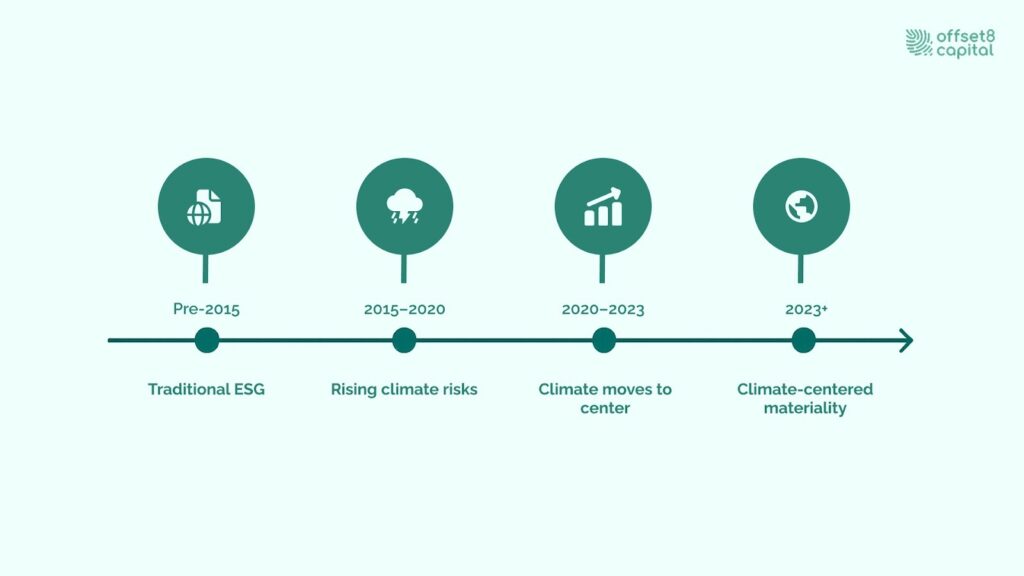

Climate considerations are the central organizing principle of modern ESG materiality frameworks. Historically, materiality focused narrowly on sector-specific ESG issues. Today, climate-focused approaches dominate, where strategic priorities, risk assessments, and ESG integration shape decision-making.

This shift is driven by intensifying climate risks, global investor demand, and evolving sustainability frameworks like Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), and the the International Sustainability Standards Board’s new IFRS S1 and S2 standards. Importantly, the Organisation for Economic Co-operation and Development’s G20 Sustainable Finance Working Group (OECD) emphasizes comparability and interoperability of ESG data, reinforcing investor confidence and driving standardization.

Materiality today is dynamic: investor net-zero commitments, regional carbon pricing, and evolving disclosure regimes continually shift what counts as material for companies. This adaptability underscores why climate has become the organizing principle in materiality analysis.

This climate materiality transformation reflects the shift from sector-based approaches to climate-centered analysis. Physical risks such as extreme weather, wildfires, and sea-level rise, along with transition risks linked to carbon pricing and regulation, have become decisive for assessing material ESG issues.

This framework evolution helps companies bring strategic climate integration into governance, making climate considerations central to risk management, reporting practices, and long-term business planning. It strengthens board oversight and scenario analysis, linking climate risk to targets, capital allocation, and decision-useful disclosures.

In fact, the Equator Principles’ Climate Change Risk Assessment guidance requires lenders to screen projects for both physical and transition risks, embedding resilience into due diligence and strengthening investor trust.

Fig 2: Evolution from Traditional ESG to Climate-Driven Materiality

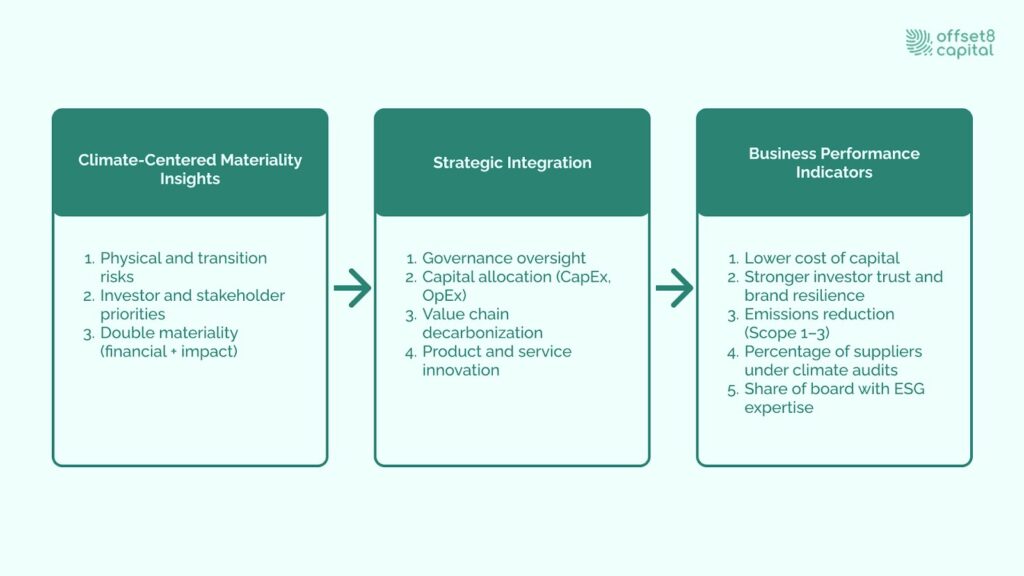

Climate-centered materiality assessments now operate as a strategic framework for institutional decision-makers. They go beyond compliance to guide climate risk assessment, shape ESG strategic planning, and drive climate decision-making across industries.

Embedding strategic climate priorities into operations and finance enables organizations to anticipate regulatory change, manage downside exposure, and uncover opportunities for growth. This forward-looking approach strengthens governance, improves resilience, and supports stronger financial performance.

Crucially, it also aligns companies with investor and stakeholder expectations in a world where climate risks are accelerating. By making climate a central organizing principle, this framework turns materiality from a reporting exercise into a practical tool for building transparent, compliant, and future-ready strategies that deliver measurable value.

Leading organizations demonstrate that climate strategy integration yields ESG value creation. Firms that go further than compliance embed climate priorities into the value chain, covering supply, capital allocation, product innovation and broader sustainability initiatives. This approach transforms strategic climate priorities into sources of competitive advantage, enhancing investor trust and brand resilience.

The Review of Accounting Studies found that firms disclosing climate risk had on average ~27 basis points lower cost of equity than non-disclosers, controlling for other factors, with larger benefits in industries where climate risk is expected to be material. Similarly, large global asset managers are prioritizing issuers with credible transition plans. This reflects OECD findings that ESG frameworks increasingly shape capital allocation, and Chartered Financial Analyst (CFA) Institute evidence that integrating climate as a primary risk improves long-term financial performance.

Fig 3: How materiality insights link to business performance indicators

The double materiality approach expands traditional analysis by addressing both perspectives: financial materiality — how climate change affects companies and other sustainability factors create risks and opportunities that affect enterprise value — and impact materiality — how companies' activities affect society and the environment.

Unlike single materiality, which primarily focuses on sustainability-related risks and opportunities that reasonably affect enterprise value, double materiality captures the broader externalities that shape systemic resilience. Anchored in the EU’s Corporate Sustainability Reporting Directive (CSRD) and complemented by the EU Taxonomy, this model requires companies to disclose how emissions, supply chains, and operations across the entire value chain create risks or benefits beyond the balance sheet, making environmental and social externalities visible and decision-useful for pricing and capital allocation. These impacts are directly connected to the goals of the Paris Agreement, understanding that the approach goes beyond risk management to encompass measurable climate outcomes and long-term value creation. The Eurasian Economic Review 2024 further highlights how the CSRD builds on Non-Financial Reporting Directive (NFRD), expanding climate and ESG indicators and aligning them with global best practice.

| Aspect | Single Materiality | Double Materiality |

| Focus | How ESG/Climate risks and opportunities affect the company’s enterprise value | How sustainability issues both affect the company (financial materiality) and how the company affects society and the environment (impact materiality) |

| Example | Carbon tax raises company’s operating costs | Company’s emissions contribute to climate change and related social/economic impacts |

| Reporting Basis | Financial risk, opportunities, and performance | Financial performance + environmental & social impacts |

Tab1: Single vs. Double Materiality with Climate Focus

Climate materiality regulations are now a core part of ESG reporting. In the EU, the CSRD requires companies to report on both financial materiality and impact materiality, with standards developed by European Financial Reporting Advisory Group (EFRAG). In the U.S., the Securities and Exchange Commission (SEC) has proposed mandatory climate disclosure rules covering emissions and governance.

Globally, TCFD compliance sets the benchmark for climate reporting, while the EU Taxonomy creates comparability across industries. Together, these frameworks ensure climate considerations are embedded in materiality assessments. They drive greater transparency, accountability, and strategic alignment between sustainability planning and long-term investment decisions.

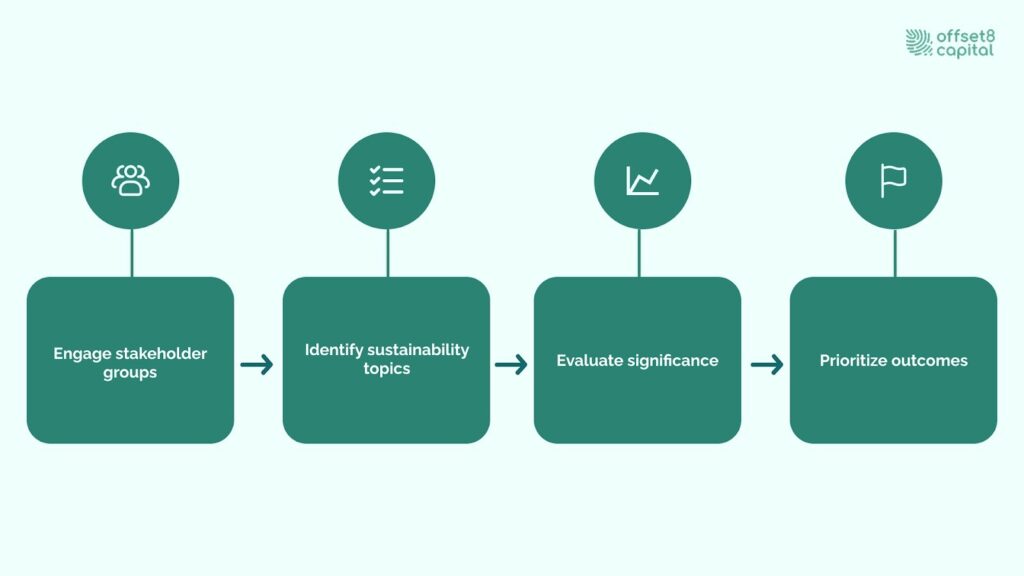

Fig 4: Process flow diagram showing key phases of materiality assessment

The materiality assessment process generally unfolds in four phases:

As highlighted by the OECD and CFA Institute, the goal of an ESG materiality assessment is to pinpoint the issues most significant to both enterprise value and societal impact. Using recognized standards in the process enhances regulatory consistency and strengthens disclosure credibility, while making the results actionable insights for investors and institutional decision-makers.

Engaging internal and external stakeholders is critical to building a credible materiality assessment. The process begins with stakeholder identification, ensuring that investors, employees, regulators, supply chain partners, and community groups are represented.

Once identified, appropriate engagement levels are established through surveys, structured interviews, and workshops. These techniques create meaningful feedback collection that highlights sustainability issues, concerns and expectations from multiple perspectives.

By integrating diverse input, organizations achieve stronger stakeholder prioritization, ensuring material issues reflect both operational realities and societal needs. Transparent approaches build trust, strengthen governance, and align outcomes with recognized corporate ESG standards.

A structured process for material topics identification begins with benchmarking against leading ESG frameworks such as GRI, SASB, ISSB, and TCFD. From there, organizations evaluate social and environmental areas, governance practices, and industry-specific risks to understand their broader environmental impact.

Tools like the SASB Materiality Finder and sectoral heatmaps support this assessment by highlighting potential impacts with the greatest financial and reputational relevance. Each issue is then assessed for both likelihood and significance, using industry benchmarks and institutional criteria to prioritize ESG factors that matter most for performance and resilience.

Materiality assessment lies in translating insights into strategy. Results should guide ESG strategy development and shape credible sustainability reporting. Organizations can use findings to set materiality-based targets that link climate priorities with measurable business outcomes. Embedding these into governance and performance systems strengthens accountability, improves measurable ESG performance, and supports alignment with broader sustainability strategies.

This strategic integration turns assessment results into clear actions that support resilience, transparency, and long-term value creation. When disclosure practices reflect what investors expect, firms strengthen trust and demonstrate that ESG is not a parallel exercise but an essential driver of company strategy and competitive performance.

| Material Topic | Strategic Response | Performance Metric |

| Climate risk | Energy transition planning | % reduction in Scope 1 & 2 emissions |

| Governance | Board oversight of ESG | Share of board with ESG expertise |

| Supply chain resilience | Climate audit of suppliers | % suppliers covered by audits |

Tab2: Material Topics, Strategic Responses, and Performance Metrics

FAQ

Single materiality looks at how ESG issues affect a company’s financial performance and the company’s sustainability over time. Double materiality adds another view: how the company impacts society and the environment. This broader approach gives investors and regulators a fuller picture of climate risks, business resilience, and long-term sustainability reporting.

Materiality assessments show which ESG issues matter most for risk and opportunity. They highlight climate risks, governance practices, and supply chain concerns that influence company performance. This guidance helps investors direct capital toward businesses better prepared for regulations, long-term resilience, and delivering measurable climate and sustainability impact.

Organizations should review materiality assessments every one to two years. Faster updates may be needed if new climate risks emerge, regulations change, or stakeholder expectations shift. Regular reviews keep strategies and reporting aligned with investor needs, regulatory standards, and evolving priorities across global markets.