Sustainability reporting is the process by which organisations disclose their environmental, social and governance (ESG) performance, risks and opportunities. As climate issues move from reputational to financial materiality, companies and investors treat the report not only as compliance but as strategic insight. This article explains core reporting frameworks, regulatory requirements, and practical steps for robust implementation in corporate climate finance and carbon-focused activity.

ESG reporting is the systematic disclosure of an organisation’s impacts on people and the environment, and how those impacts affect its ability to create value over time. Initially focused on environmental metrics, modern sustainability reporting embraces an integrated ESG (environmental, social and governance) view. However, this article focuses particularly on the environmental aspect given its significance for climate finance and carbon instruments.

A typical sustainability report includes governance, strategy, metrics and targets, and a disclosure of material risks and opportunities. Sustainability reporting has become decision-useful financial information rather than PR artifacts, especially as investors demand climate-related transparency, particularly where climate-related financial risk is evident.

Historically the practice moved from voluntary guidelines in the 1990s to more structured frameworks; non-financial reporting and sustainability disclosure standards have steadily raised the bar for comparability and assurance. The modern sustainability report therefore blends narrative, quantitative metrics (for example greenhouse gas inventories) and assurance statements, moving closer to integrated reporting that connects financial and sustainability data.

The purpose of reporting on sustainability is threefold:

High-quality reporting increases trust among stakeholders and reduces greenwash risks. For organisations active in carbon markets, a sustainability report codifies how carbon credits and offsets fit within a broader climate strategy and provides essential disclosure about methodology, verification and permanence. This is critical where credits are used in voluntary or compliance contexts.

Fig 1. The Evolution of Sustainability Reporting

What began as voluntary corporate social responsibility reports evolved through multi-stakeholder standards and EU initiatives such as the NFRD (Non-Financial Reporting Directive) toward mandatory reporting in many jurisdictions. The IFRS (International Financial Reporting Standards) Foundation’s creation of the International Sustainability Standards Board (ISSB) and consolidation of other initiatives marked a major step in global standardisation.

Regulators now demand more granular disclosures and stricter reporting requirements, especially about climate risks and greenhouse gas (GHG) accounting. The shift has accelerated because markets and policymakers require comparable, decision-useful information to price climate risk and direct capital.

As disclosure standards mature, companies are effectively building a system of climate-related accounting — a form of environmental bookkeeping integrated into mainstream finance. Under frameworks such as Task Force on Climate-Related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), and the Global Reporting Initiative (GRI), ESG information is no longer optional commentary but structured data that investors, regulators and auditors can test for assurance.

This shift demands robust governance, consistent methodologies and evidence of material sustainability factors that directly influence sustainability performance and corporate reputation. In global supply chains, transparent social and environmental reporting now underpins access to capital and trade compliance, reinforcing the link between credible sustainable development strategy and financial resilience.

High-quality sustainability reporting is essential for unlocking capital for impactful climate and environmental solutions. It enables investors to clearly assess how organizations measure and manage climate risks, environmental impacts, and broader sustainability challenges. This transparency builds investor confidence and is a key driver in accessing climate finance.

In the climate finance ecosystem, instruments like renewable energy investments, green bonds, natural-capital accounting, and climate risk insurance all depend on credible sustainability reporting. Effective disclosure of climate-related risks can lead to better risk pricing, increased capital flow, and faster deployment of funds toward high-impact, high-integrity projects. Carbon markets, including carbon credits, represent just one facet of this broader financial landscape.

When organizations incorporate robust and transparent disclosures into their sustainability reports, they reduce information asymmetry between capital providers and project developers. This enhanced transparency not only fosters more accurate risk assessments but also streamlines funding for sustainable projects, ensuring that financial resources are allocated efficiently and effectively throughout the value chain.

Clear sustainability reporting enhances the credibility of carbon markets by enabling project developers, intermediaries, and buyers to distinguish high-quality carbon credits from lower-integrity alternatives. This transparency supports price premiums for verified, permanent removals and nature-based solutions, driving market confidence.

Additionally, for carbon market organizations, a robust sustainability report demonstrates consistent governance, verification, and measurable climate outcomes, which facilitates access to institutional capital and fosters stronger procurement and partnership opportunities.

Several frameworks coexist; organisations commonly align to different sustainability reporting standards to satisfy diverse stakeholder expectations.The most influential include:

Using a blended approach — e.g., ISSB for investor-facing, GRI for impact-focused disclosure, and TCFD for climate governance — helps organisations meet both investor needs and broader stakeholder expectations.

| Framework / Standard | Main purpose | Legal status | Climate-finance relevance | Typical use |

| ISSB S1/S2 | Investor-focused sustainability & climate disclosure | Global IFRS baseline (adopted by regulators) | Strategy, risks, metrics, financial effects, CAPEX/OPEX, scenario analysis | Annual/investor reporting |

| TCFD | Framework for climate-related financial disclosure | Voluntary, regulator-endorsed | Four pillars: governance, strategy, risk, metrics; scenario analysis | Embedded in ISSB S2 |

| SASB | Industry-specific financially material ESG metrics | Voluntary | KPIs link climate risks to revenue, assets, capital costs | 77 industries; integrated in ISSB S2 |

| GRI | Impact-focused reporting for broad stakeholders | Voluntary | GHGs, energy, climate impacts; less financial detail | Supports double materiality view |

| CDP | Data collection & scoring platform | Voluntary but investor-requested | 2024 questionnaire aligned to ISSB S2; transition plans, targets | Quick path to S2-aligned dataset |

| ESRS (CSRD) | EU mandatory double-materiality reporting | Legally required for CSRD entities (from FY 2024) | ESRS E1: transition plan, CAPEX/OPEX, financial effects | EU compliance reporting |

Tab1: Major Reporting Frameworks Comparison

The Global Reporting Initiative (GRI) provides standards that emphasise environmental and social impacts, making it well suited for reporting project-level environmental outcomes and community co-benefits. GRI’s multi-stakeholder process helps organisations present contextualised, impact-driven disclosures.

On 9 September 2025 ISO and the GHG Protocol announced a strategic partnership to harmonize their portfolios (including the ISO 1406x series and GHG Protocol Corporate/Scope 2/Scope 3) and co-develop unified global standards for GHG accounting—creating a common language that supports assurance and interoperability with investor-focused disclosure regimes (e.g., ISSB).

The Task Force on Climate-related Financial Disclosures (TCFD) focuses on governance, strategy, risk management and metrics — framing climate disclosure in financial terms. Many regulators and investors use TCFD as the baseline for climate risk reporting and scenario analysis.

Regulatory momentum is strongest in the European Union (EU), where the Corporate Sustainability Reporting Directive (CSRD) introduces mandatory, standardised sustainability reporting requirements for large companies and listed entities across the European Union, with the European Sustainability Reporting Standards (ESRS) specifying metrics and disclosures.

In the United States, the Securities and Exchange Commission (SEC) has proposed enhanced climate disclosure rules that would require registrants to report climate-related risks and greenhouse gas emissions. The rulemaking process has been subject to legal and political challenges; disclosure timelines continue to evolve. Organisations active in carbon markets should monitor jurisdictional developments to ensure compliance.

Under the CSRD, companies must report using the ESRS, which require clear, disaggregated treatment of carbon credits within climate disclosures. In particular, ESRS E1 requires reporting gross GHG emissions separately from any use of credits, and specific disclosure of GHG removals and mitigation projects financed through carbon credits (E1-7).

These rules don’t “ban” credits, but they force clarity on when and how credits are used, alongside transition plans, targets and other climate metrics, shaping higher-integrity demand and pricing signals in EU-facing carbon markets.

Companies should always verify how credits are treated under the laws of each jurisdiction in which they operate, but for EU reporting, the CSRD/ESRS framework sets the disclosure baseline that investors and counterparties will expect.

Effective sustainability reporting is a foundation for credible participation in the climate finance ecosystem — from renewable-energy investment and green bonds to carbon markets and climate-risk disclosure.

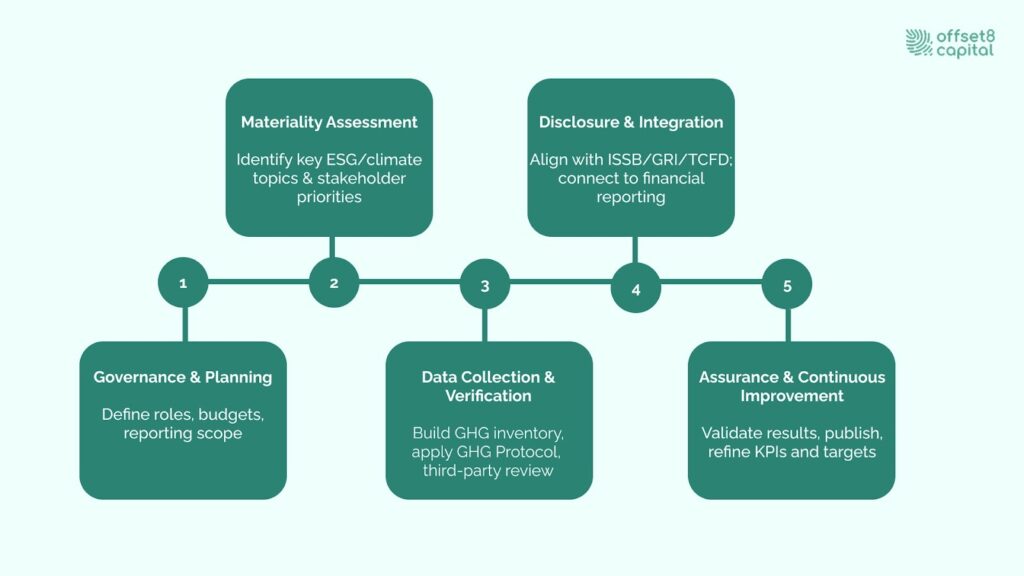

A practical reporting process includes: governance assignment, materiality assessment, robust data collection and verification, target setting, and stakeholder communication. Centralise GHG inventory management, adopt recognised accounting methodologies, and engage independent verification to strengthen credibility.

Form cross-functional teams (finance, risk, sustainability, and procurement) and select reporting frameworks aligned with stakeholder needs (investors, lenders, and communities). Investing in systems for data lineage and audit trails enables third-party assurance, building investor confidence and improving access to capital for climate-aligned projects.

Fig 2. Step-by-Step Sustainability Reporting Implementation

Materiality in sustainability reporting means identifying topics that influence stakeholder decisions and enterprise value. For carbon market organisations, material topics typically include project additionality, permanence, leakage, verification, community impacts and legal/regulatory risk. Use stakeholder engagement and evidence-based scoring to prioritise disclosures.

Collecting reliable climate data requires standardised templates, consistent measurement boundaries, and a centralized database. Leverage third-party verification bodies and technology providers for remote sensing, monitoring and automated emissions calculations while preserving auditability. Address Scope 1, Scope 2 and Scope 3 emissions consistently and document methodological choices.

High‑quality, verifiable carbon credits play a supportive role in enhancing the credibility of sustainability reporting. They provide tangible proof that reported emission reductions are linked to recognised projects, verified methodologies and independent assurance. Essential quality attributes of these credits — including additionality, permanence, conservative baselines and co‑benefit safeguards — ensure that sustainability claims remain robust and trustworthy.

For investors, transparency in sustainability reporting is essential for assessing the long‑term value and risks of carbon projects. High‑quality carbon credits, when paired with clear and reliable disclosures, offer valuable insights into factors like additionality, permanence, and co‑benefits. This enables investors to make informed comparisons, integrate climate risks into their portfolio management, and allocate capital more effectively, supporting projects with positive financial returns and climate impact.

Sustainability reporting faces several challenges, such as inconsistent metrics, fragmented standards, limited assurance, and gaps in data, especially when it comes to Scope 3 emissions. These challenges can be addressed by adopting a primary reporting standard, which ensures consistency and clarity. Additionally, it's important to clearly document the methodologies used for collecting and analyzing data.

Investing in third-party verification and using digital traceability tools can further improve the accuracy and transparency of the information, helping to overcome these common obstacles. Close collaboration with verification bodies and project developers reduces uncertainty around credit quality.

Sustainability reporting also serves as a powerful tool for creating value in climate finance by revealing operational efficiencies, demonstrating competitive differentiation, and informing product development (e.g., premium credits with verified co-benefits). Transparent reporting helps gain access to capital, improve procurement terms, and build stakeholder trust — transforming disclosure from a cost into a commercial advantage.

For communicating climate impact to stakeholders, tailor narratives to different audiences: quantitative, risk-focused for investors, and impact-driven for communities and consumers. Clear, verifiable metrics and storytelling help explain how credits, project activities, and methodologies lead to tangible climate and environmental outcomes.

Looking ahead, future trends in sustainability reporting in climate finance will continue to focus on improving standardization, verification, and transparency, supporting more effective climate action. Expect further convergence of standardization across global supply chains (notably between ISO and the GHG Protocol), more stringent assurance expectations, and greater regulatory harmonization across jurisdictions — trends that will increase comparability and investor confidence. Digital taxonomies and blockchain traceability are likely to play growing roles in credit provenance.

FAQ

Use investor-facing standards like ISSB for financial materiality and TCFD for climate governance, while adopting GRI to disclose project-level social and environmental impacts and assurance.

Publish auditable methodologies, third-party verification and project co-benefit metrics; integrate credits into a clear climate strategy and disclose procurement criteria to reduce perception risk.

High-quality credits provide verifiable emission reductions, support credible net-zero claims, and enhance the transparency and trustworthiness that sustainability reporting provides to investors and regulators. Leakage, and permanence are key integrity criteria, while validation and verification ensure these criteria are met and maintained.