Established in 2015 by CDP, UN Global Compact, WRI, and WWF, the Science Based Targets initiative (SBTi) provides an authoritative framework for corporate emissions reduction aligned with the goals of the Paris Agreement goals. Its mandate is to translate climate science into actionable business targets that limit global warming to 1.5°C while providing companies clear pathways for decarbonization.

SBTi Corporate Net-Zero Standard Version 1.0 (October 2021) established foundational methodologies for science-based targets, creating a common language for corporate climate commitments. Under Version 1, the role of carbon credits is limited to neutralizing residual emissions once companies have achieved their long-term science-based targets (by 2050 at the latest), and thereafter, as well as to financing Beyond Value Chain Mitigation (BVCM). SBTi has consistently prioritized value-chain emissions reductions since Version 1, with the draft of Version 2 further clarifying and institutionalizing the role of carbon credits for residual emissions neutralization and ongoing emissions responsibility.

Following a 90-day public consultation in which over 855 stakeholders provided input, the SBTi’s Corporate Net-Zero Standard Version 2.0 second consultation draft (November 2025) strengthens the cross-sector framework and updates the treatment of mitigation outcomes and carbon credits. The draft maintains deep value-chain decarbonization as the core priority, requires companies to neutralize residual emissions at the net-zero target year and beyond using carbon dioxide removals with specified durability thresholds, and introduces an Ongoing Emissions Responsibility framework through supplementary climate contributions, with illustrative integrity principles set out in Annex E.

Draft Version 2 introduces:

Expert Working Groups provided input to develop illustrative integrity principles for mitigation outcomes and claims (Annex E).

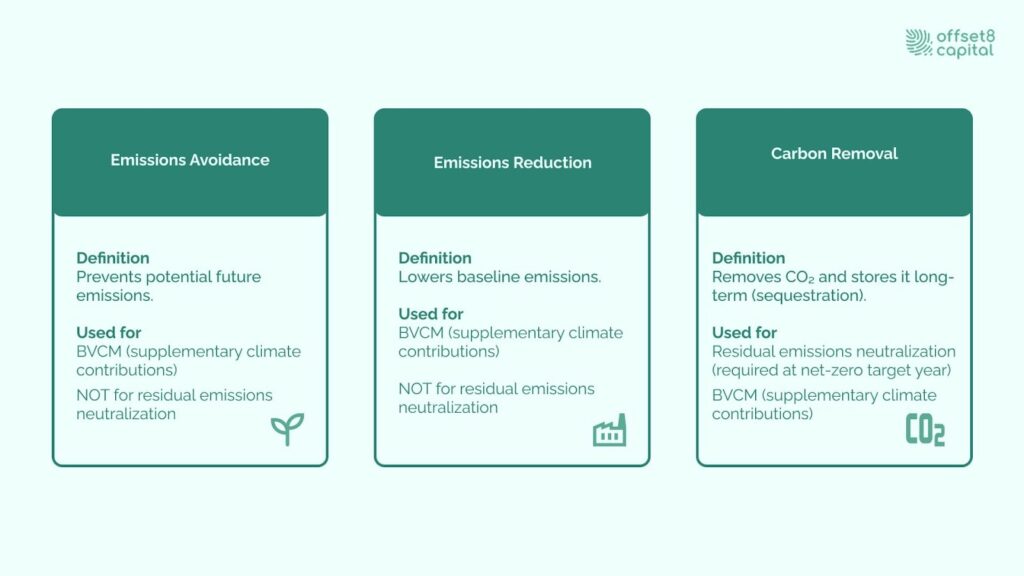

In the Corporate Net-Zero Standard Version 2.0 second consultation draft, SBTi proposes a taxonomy of mitigation outcomes and carbon credits into avoidance, reduction, and removal.

| Credit Type | Description |

| Emissions Avoidance Credits | Prevents potential future emissions |

| Emissions Reduction Credits | Lowers baseline emissions |

| Carbon Removal Credits | Permanent CO₂ sequestration |

Table 1: SBTi Carbon Credit Classification Framework

Emissions avoidance and reduction credits arise from projects preventing or lowering emissions.

Carbon removal credits include engineered and nature-based pathways such as ARR, biochar, and direct air capture with storage (DACCS). Under the SBTi net-zero framework, residual emissions must be neutralized using carbon dioxide removals that meet durability requirements, following at least 90% value-chain emissions reductions.

Nature-based solutions combine reforestation with community programs, creating integrated benefits where forest restoration generates removal credits while cookstove distribution creates reduction credits.

The Integrity Council for the Voluntary Carbon Market (ICVCM) has established a global quality benchmark through its ICVCM Core Carbon Principles (CCPs) – ten science-based criteria addressing additionality, permanence, robust quantification, and double counting prevention.

Institutional Investment Criteria and Verification

Major carbon crediting programs – Verra and Gold Standard – have been assessed by the ICVCM and recognized as CCP-Eligible at the program level, subject to further methodology- and credit-level approval. At the project level, credit issuance under these programs requires independent third-party validation and verification by accredited bodies. This process typically includes audits of project documentation, baseline and additionality assessments, and monitoring protocols, as well as the application of transparent MRV systems and registry mechanisms designed to prevent double counting. For many nature-based projects, permanence risks are managed through program-specific safeguards such as buffer or risk-pool arrangements. Separately, sector-specific compliance schemes, such as ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), establish their own mandatory eligibility criteria for the use of carbon credits, distinct from voluntary market quality frameworks.

Market Evolution and Voluntary Quality Standards

ICVCM’s market analysis indicates growing quality focus: CCP-labelled credits command approximately 25% price premiums, with nearly 40% of buyers actively seeking certified credits. Organizations implementing voluntary quality assurance frameworks increasingly evaluate project developer reputation, governance structures, methodology robustness, and co-benefits delivery, helping ensure consistent portfolio standards across diversified holdings spanning geographies, methodologies, and vintages.

In the development of SBTi’s Corporate Net-Zero Standard v2.0, expert working groups explored two potential approaches to durability thresholds, including a like-for-like approach and a gradual transition pathway.

Like-for-like approach — Match removals to the atmospheric lifetime of specific greenhouse gases being neutralized, requiring companies to report emissions by individual GHG type and align removal pathways accordingly.

Gradual transition approach — Use a mix of removals with varying durability, gradually increasing the share of long-lived carbon dioxide removal aligned with 1.5°C pathways. By 2050, at least 41% must come from long-lived removals, with 59% from short-lived solutions.

Long-lived removals (direct air capture, biochar, geological storage) offer centuries-to-millennia permanence. Short-lived removals (nature-based solutions like reforestation) provide decades of storage with reversal risks from fires, disease, or land-use changes, managed through buffer pools and insurance mechanisms.

While these discussions do not establish formal requirements at this stage, they provide an indication of how SBTi may approach the role of durability in the neutralization of residual emissions going forward.

Residual emissions are a subset of ongoing emissions that are expected to remain unabated at the net-zero target year, after all feasible abatement measures have been implemented in line with the company's SBTi-validated pathway.

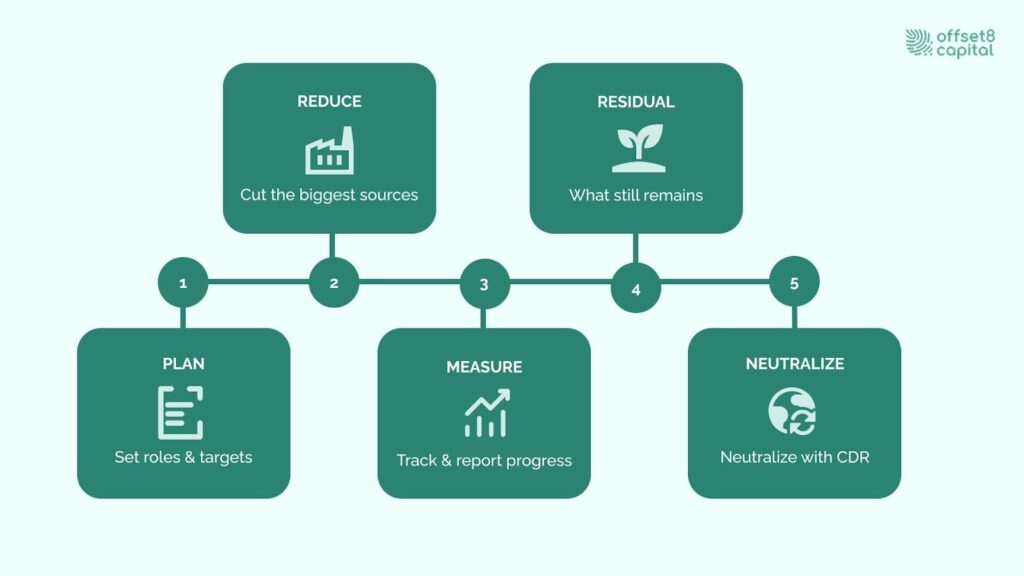

Deep value-chain decarbonization forms the foundation of credible net-zero strategies. The SBTi Corporate Net-Zero Standard prioritizes rapid and deep emissions reductions across the value chain as the foundation of net-zero strategies. Only after the vast majority of emissions have been abated are companies expected to address remaining residual emissions through permanent carbon removal, consistent with pathways that limit global warming to 1.5°C.

Fig 1: Three credit types — and where each one counts in SBTi

Following comprehensive value-chain reductions, carbon dioxide removals scale to cover 100% of residual emissions across the value chain by the net-zero target year.

Certain emission sources in hard-to-abate sectors are expected to remain at the net-zero target year despite implementing best-available abatement technologies. For these residual emissions, verified carbon dioxide removal serves a strictly limited role: neutralizing the impact of emissions that cannot be eliminated through value-chain transformation.

Carbon removal credits apply only after companies achieve comprehensive reductions, ensuring that abatement—not neutralization—drives corporate climate strategies.

Project pipeline development across key geographic regions supports scalable carbon removal deployment:

These regional pipelines position emerging markets as critical suppliers of carbon removal solutions for global corporate net-zero strategies.

The SBTi Corporate Net-Zero Standard Draft Version 2.0 reframes Beyond Value Chain Mitigation as a recognition program for supplementary climate contributions, addressing the conceptual challenge that "removals may occur inside or outside a company's value chain" while broadening the scope beyond mitigation to include adaptation and loss and damage initiatives.

Expanded Framework:

BVCM encompasses "mitigation action or investments that fall outside a company's value chain, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere." Draft Version 2 introduces "supplementary climate contributions" — expanding eligible activities to carbon credit purchase and retirement, direct mitigation investments, R&D support, and climate finance spanning adaptation, resilience, and loss and damage.

Recognition Structure:

The optional program until 2035 offers two tiers: "Recognized" status (≥1% of ongoing emissions addressed) and "Leadership" status (≥$80/tCO₂e applied to 100% of ongoing emissions with ≥40% as ex-post mitigation). Strong integrity principles ensure contributions are made "above and beyond value chain targets" and prevent double-counting. Mandatory requirements begin in 2035 for Category A companies.

Implementation:

Structured approaches support long-term strategies through diversified portfolios spanning ARR projects meeting ICVCM standards, creating systematic pathways for corporate sustainability beyond compliance requirements.

Draft Version 2 implementation follows a phased approach reflecting stakeholder feedback. The public consultation process closing December 12, 2025 (midnight Pacific Time) enables industry input on critical provisions including residual emissions neutralization timelines, BVCM recognition mechanisms, and durability requirements. Final standard publication expected in early 2026 will establish definitive guidance for corporate net-zero targets aligned with 1.5°C pathways.

Fig 2: The Path to Residual Neutralization

According to SBTi, companies may continue using Version 1.3 until December 31, 2027. From January 1, 2028, all companies will be required to use Version 2 for setting new targets. Organizations with existing Version 1.3 commitments may maintain those targets during transition.

According to the November 2025 Draft for the Second Public Consultation, enhanced governance mechanisms strengthen accountability through multiple oversight layers, including:

These differentiated requirements balance ambition with achievability across diverse corporate landscapes.

Third-party verification forms the cornerstone of credible carbon markets, with MRV systems operating through methodologies. Accredited auditors assess documentation, baseline scenarios, monitoring plans, and safeguards before credit issuance, with periodic verification confirming projected outcomes.

Core verification elements include additionality testing evaluating financial/technological/policy barriers, ICVCM Core Carbon Principles establishing market-led integrity framework, and double counting prevention through registry systems.

Emerging technologies are increasingly improving the efficiency of carbon credit verification.

These innovations enhance third-party auditors, enabling more frequent monitoring cycles strengthening institutional investor confidence.

Regulated investment approaches demonstrate how institutional capital can effectively navigate SBTi compliance requirements through comprehensive due diligence frameworks.

Our systematic project evaluation methodology ensures compliance with evolving regulatory frameworks while providing institutional clients with transparent access to verified climate impact across diverse geographic regions and carbon removal technologies.

Implementing the SBTi Corporate Net-Zero Standard Version 2 Second consultation draft often leads companies to supplement internal sustainability teams with external carbon-market expertise. Advisory firms and market-access providers help clients navigate global carbon markets, develop mitigation strategies, and access carbon credits aligned with decarbonization and sustainability goals.

Specialized evaluators support carbon credit quality assessment and project due diligence, helping buyers distinguish high-integrity opportunities and avoid reputational risk. Institutional investors apply formal climate-related due-diligence frameworks, integrating climate risks and transition finance into governance and investment processes.

Together, these strategic partnerships and due-diligence practices help organizations integrate carbon finance into science-based decarbonization plans and align credit use with emerging integrity benchmarks such as ICVCM’s Core Carbon Principles and CORSIA’s emissions-unit eligibility criteria.

Draft Version 2 reflects implementation experience, stakeholder consultation, and scientific advancement through critical updates:

| Update Area | Version 1.0 (October 2021) | Draft Version 2.0 (November 2025) |

| BVCM Recognition | Beyond value chain mitigation recommended | Recognition mechanism with two tiers: Recognized and Leadership |

| Scope 3 | Near-term and long-term targets required | Three target-setting approaches: emissions intensity, activity alignment, counterparty alignment |

| Governance | Two public consultations and company road test | Cyclical validation model with spot checks |

| Expert Input | Net-Zero Expert Advisory Group | Expert Working Groups |

Table 2: Evolution from Version 1.0 to Draft Version 2.0: Structural and Governance Enhancements

Progressive responsibility for ongoing emissions is operationalized through a two-tier recognition mechanism aimed at acknowledging early corporate action. The revised Scope 3 framework adopts a more focused and flexible structure, offering multiple target-setting pathways to reflect the heterogeneity of value chain emissions. A cyclical validation model, complemented by spot checks, further reinforces accountability.

The International Emissions Trading Association (IETA) submitted its response on 12 December 2025 to the second consultation on the SBTi Corporate Net-Zero Standard (CNZS) Version 2.0. IETA welcomes the progress made compared to earlier drafts, particularly the clearer recognition of the role that carbon credits, removals, and climate finance can play in supporting corporate climate action.

At the same time, IETA emphasizes that further practical refinement is needed to strengthen corporate adoption and enable effective decarbonization, especially given the challenges companies face—most notably in addressing Scope 3 emissions. IETA encourages SBTi to adopt a pragmatic, forward-looking approach that allows high-integrity emissions reduction and removal credits to play a strategic role throughout the decarbonization journey, supported by appropriate guardrails and transparency.

Aligning the Net-Zero Standard with real-world corporate needs and established quality frameworks, IETA argues, will be essential to translating ambition into meaningful emissions reductions and scaled investment.

The SBTi Corporate Net-Zero Standard Draft Version 2 further develops corporate climate frameworks by balancing scientific rigor with practical implementability, while providing clearer guidance on the role of high-quality carbon credits. The consultation process, open through 12 December 2025, is intended to refine key design elements, including the treatment of residual emissions, the recognition of Beyond Value Chain Mitigation (BVCM), and durability-related considerations.

The draft maintains a strong emphasis on deep value-chain emissions reductions as the foundation of corporate net-zero strategies. At the same time, it clarifies the role of carbon dioxide removals in addressing residual emissions at the net-zero target year and introduces a framework for addressing ongoing emissions through BVCM as a form of voluntary corporate leadership. Growing stakeholder engagement reflects an ongoing, market-wide discussion on how carbon credits and climate finance should be positioned as complementary tools alongside direct emissions reductions.

For institutional investors and corporate decision-makers, effective implementation planning requires a clear understanding of both the current requirements of the draft and its potential evolution in response to stakeholder feedback. Corporate climate action is expected to continue prioritizing ambitious value-chain emissions reductions, complemented by the strategic use of climate finance and supplementary climate contributions directed toward high-impact mitigation activities with measurable outcomes. As the framework evolves, the interaction between direct emissions reductions and carbon market mechanisms will continue to shape credible pathways toward achieving the goals of the Paris Agreement.

Disclaimer

This commentary is for informational purposes only and should not be considered financial, investment, or regulatory advice. Offset8 Capital Limited is regulated by the ADGM FSRA (FSP No. 220178). No assurances or guarantees are made regarding its accuracy or completeness. Views expressed are our own and subject to change

Under the SBTi Corporate Net-Zero Standard Draft Version 2, carbon dioxide removals are primarily addressed in the context of neutralizing residual emissions at the net-zero target year and beyond. The draft distinguishes removals from emissions reductions and positions them as a separate category within the net-zero framework. Eligible approaches are expected to meet defined integrity and durability expectations and may include both nature-based and engineered removal pathways, subject to further specification in the final standard.

Draft Version 2 links durability considerations to the climate impact and atmospheric lifetime of the greenhouse gas being neutralized. For carbon dioxide (CO₂), the draft indicates an expectation of long-lived carbon storage, reflecting the long residence time of CO₂ in the atmosphere. This principle is intended to support climate equivalence between emissions and removals, while allowing further refinement of durability criteria through the consultation process.

Draft Version 2 does not introduce a fully standalone definition of “high-integrity” carbon credits. Instead, it emphasizes alignment with recognized integrity benchmarks and quality frameworks, including robust monitoring, reporting and verification, safeguards against double counting, and measures addressing permanence and reversal risks. The draft signals that SBTi intends to rely on established external standards rather than creating an entirely new credit quality framework.

The SBTi Corporate Net-Zero Standard Draft Version 2 entered public consultation in November 2025, with the consultation closing on 12 December 2025. The final version of the standard is expected to be released in early 2026. Companies may continue to use the existing Version 1.3 framework during the transition period, after which Version 2 will apply for the setting of new targets, in line with SBTi’s published transition guidance.

Draft Version 2 does not prescribe specific procurement, investment, or due-diligence requirements for regulated funds. The standard focuses on corporate target-setting and the use of mitigation measures within net-zero strategies. Any approaches taken by regulated funds to align procurement or investment decisions with SBTi principles fall outside the scope of the draft and reflect broader market practice or regulatory considerations rather than explicit SBTi requirements.