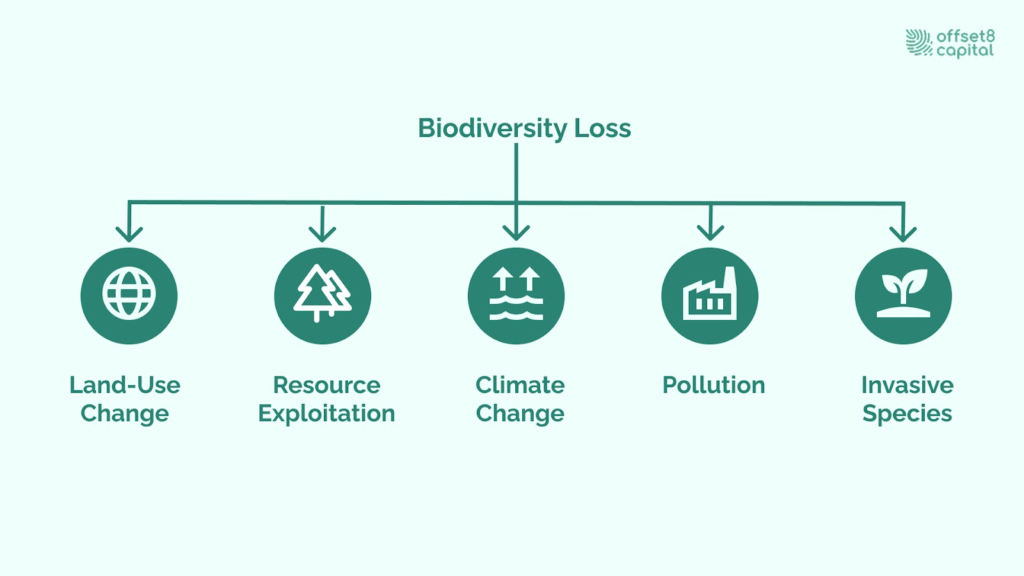

With $44 trillion of Gross Domestic Product (GDP) dependent on nature and the Kunming-Montreal Global Biodiversity Framework targeting $200 billion annually by 2030, biodiversity investment and carbon credits present a critical opportunity for the global investment industry. The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) has identified five drivers of biodiversity loss, underscoring the importance of directing capital toward solutions that enhance both ecological and financial resilience.

Market dynamics show that biodiversity-linked carbon credits deliver greater permanence, attract premium valuations, and align with evolving environmental, social and governance (ESG) requirements across markets. For investment managers, this signals a growing opportunity to integrate environmental investment strategies that generate both measurable conservation outcomes and competitive financial performance.

This guide provides actionable investment advice on how to leverage biodiversity as both a value driver and a risk mitigation tool, ensuring portfolios remain resilient in an era of rapid environmental and regulatory change.

Biodiversity credits and carbon credits serve different purposes and work through distinct frameworks, though they sometimes overlap in practice.

Biodiversity credits do not aim to offset environmental damage elsewhere. Unlike carbon credits, which are traded globally, biodiversity credits are, as of now, tied to unique local ecosystems and primarily focus on supporting ecosystems directly. They are not yet standardized and typically not traded on secondary markets.

While the frameworks differ, they increasingly intersect:

Many carbon projects now integrate biodiversity as a co‑benefit. Under Verra’s Climate, Community & Biodiversity (CCB) Standards, projects that deliver both climate and biodiversity outcomes may command a ~30% premium over standard carbon credits, demonstrating that investors value integrated environmental and social outcomes.

This means biodiversity may enhance the value and integrity of carbon-credit projects, even if those projects remain primarily focused on emissions reductions.

Biodiversity is crucial for carbon markets due to the role healthy ecosystems play in climate regulation, strengthening the case for finance for biodiversity. Ecosystem services are valued at $125 trillion annually, with biodiversity supporting their stability. Loss of biodiversity weakens forests’ resilience to disease, fire, and climate shocks, threatening their carbon storage capacity and creating biodiversity-related risks for projects.

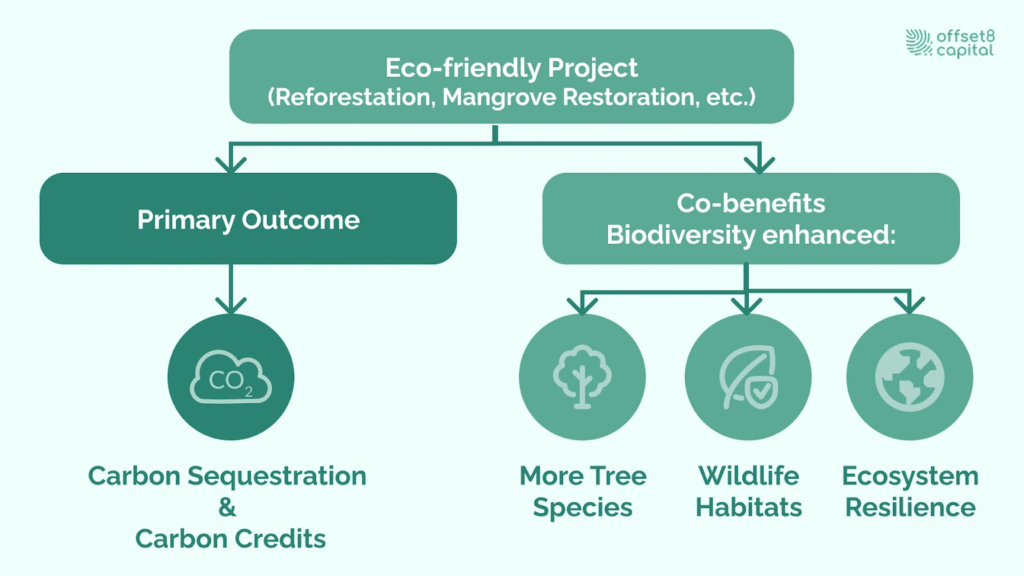

Carbon credits have traditionally focused on quantifying and verifying emissions reductions. However, as scientific evidence highlights the role of healthy ecosystems in long-term carbon storage, biodiversity has become a critical co-benefit within the carbon credit landscape. Projects verified under the Climate, Community & Biodiversity (CCB) Standards, managed by Verra, now require evidence of climate, community, and biodiversity outcomes in addition to emissions reductions.

This evolution means that biodiversity is increasingly protected or enhanced through projects primarily designed for carbon markets. Examples include forest conservation initiatives that don’t only generate verified carbon credits but also safeguard species habitats, while restoration projects improve ecosystem connectivity. Globally significant sites achieving Biodiversity Gold Status demonstrate how co-benefit certification strengthens permanence, reduces project risk, and enhances value for investors.

Fig 1. Biodiversity-Carbon Value Chain

In February 2025, parties convened in a meeting to make a decision on financing biodiversity. The conversation started at the 2024 United Nations Biodiversity Conference (CBD COP16) in Colombia months earlier. Focusing on effective ways to close the biodiversity finance gap, governments adopted the first global strategy to finance biodiversity.

Each year, the world falls $700 billion short of the funding needed to protect and restore nature. To close the gap, the parties agreed to reform harmful subsidies — like new concessions for oil and gas in critical ecosystems, and enhance financial mechanisms. While the strategy was monumental, countries are now realizing the scale of the biodiversity crisis.

Regulatory frameworks, like the Taskforce on Nature-related Financial Disclosures (TNFD), set nature-related risk disclosure requirements, and the Global Biodiversity Framework establishes clear strategy targets. The World Economic Forum identifies trillion-dollar business opportunities in nature-positive transitions, making biodiversity integration a financial necessity for long-term value creation.

The biodiversity crisis requires urgent financial mobilization, catalyzing flows into any biodiversity investment fund. The Kunming-Montreal Global Biodiversity Framework aims for $200 billion annually by 2030 for biodiversity protection, but current financing falls short. With the five drivers of biodiversity loss — land-use change, resource exploitation, climate change, pollution, and invasive species — accelerating ecosystem degradation, traditional funding methods are inadequate. This gap presents both an environmental need and a market opportunity for innovative finance solutions.

Fig 2. Five drivers of biodiversity loss

Biodiversity investment through enhanced carbon credits offers a powerful solution, creating self-sustaining financial flows that reward measurable conservation outcomes — a scalable pathway for conservation finance. Projects linked to the UN Sustainable Development Goals (SDGs) command an 86% price premium, reflecting strong demand for comprehensive environmental benefits addressing biodiversity loss drivers.

Although these credits differ, biodiversity is increasingly recognized within carbon projects as a valuable co‑benefit for investment decisions:

Integrating biodiversity not only increases price premiums but also significantly alters project risk profiles. Healthier ecosystems improve carbon storage resilience, offering greater protection against climate shocks, disease, and disturbances.

Moreover, biodiverse projects reduce leakage risks by addressing deforestation drivers — such as direct exploitation of natural resources — at a landscape scale, effectively minimizing harmful activity displacement.

Blue carbon ecosystems, including mangrove forests, seagrasses, and salt marshes, cover just 1% of the ocean floor but store up to 10 to 100 times more carbon per unit area than terrestrial forests, making them a premium conservation finance opportunity. These high carbon sequestration rates, combined with biodiversity and ecosystem service benefits, make blue carbon a premium investment opportunity. The investment process must focus on biodiversity intactness and restoring degraded coastal habitats.

Mangrove restoration projects highlight the dual benefits of carbon and biodiversity enhancement, supporting species like sharks, whales, and sea turtles, while providing services such as coastal protection and water purification. The MarVivo Magdalena Bay Project shows how well-designed blue carbon initiatives create positive second-order effects beyond carbon sequestration. Seagrass conservation also presents a strong investment case, as these meadows sequester carbon for up to ten times longer than tropical forests while supporting marine biodiversity. The growing blue carbon credit market is driven by premium pricing due to measurable biodiversity co-benefits and enhanced permanence.

Reducing Emissions from Deforestation and Forest Degradation (REDD+) initiatives extend beyond preventing deforestation to actively enhance biodiversity through restoration and sustainable management practices. Approaches range from natural regeneration to assisted restoration and sustainable forestry practices, with community-led projects in Vietnam and Tanzania successfully restoring degraded forests while recovering endemic species.

Indigenous partnerships are fundamental to REDD+ success, as Indigenous communities manage over one-third of global biodiversity hotspots, with 42% of their territories maintaining good ecological conditions.

These communities integrate traditional knowledge with modern conservation strategies. Advanced monitoring technologies enhance biodiversity tracking, including environmental DNA (eDNA) analysis for detecting species without direct observation, remote sensing via satellites and drones for large-scale habitat assessment, and AI-powered camera trap analysis. Properly implemented REDD+ delivers unprecedented biodiversity benefits while respecting Indigenous rights and ensuring consistency with conservation objectives.

Regenerative agriculture represents an underutilized opportunity for biodiversity impact investing. These projects transform agricultural landscapes through practices that rebuild soil organic matter, enhance biodiversity, and sequester carbon. The integration of diverse crop rotations, cover cropping, and reduced tillage creates habitats for pollinators while improving soil health.

Pollinator habitat creation within agricultural systems generates measurable ecosystem service improvements. Projects that establish hedgerows, wildflower strips, and diverse cropping systems support critical pollinator populations while enhancing agricultural productivity. These biodiversity gains translate into tangible economic benefits through improved crop yields and reduced input costs.

Measurable ecosystem service improvements extend beyond carbon sequestration. Regenerative agriculture projects demonstrate enhanced water retention, reduced erosion, improved nutrient cycling, and increased resilience to climate extremes. These multiple benefits create diversified value streams that reduce project risk while maximizing environmental impact.

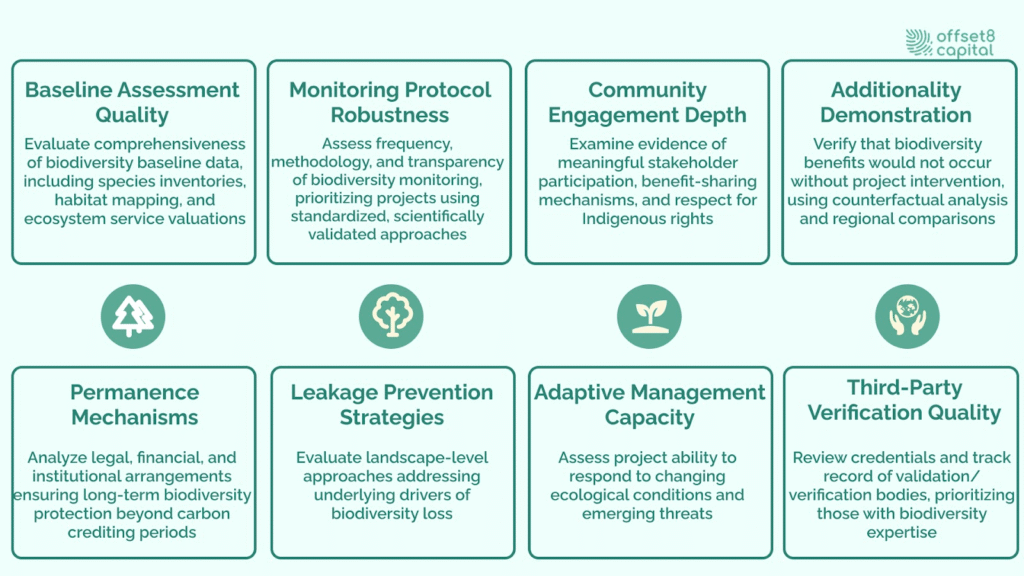

Rigorous due diligence distinguishes successful biodiversity investment fund portfolio diversification and investment strategies. Verra and Gold Standard biodiversity methodologies provide established frameworks for assessment, yet investment managers must look beyond certification labels to evaluate true impact on biodiversity. The investment process requires comprehensive analysis aligned with IPBES scientific assessments and the Kunming-Montreal Global Biodiversity Framework targets. This thorough investment process ensures projects genuinely address drivers of biodiversity loss while generating returns.

Fig 3. Project Evaluation Framework

BeZero Carbon ratings increasingly incorporate nature co-benefits into credit assessments, providing independent evaluation of biodiversity claims. Red flags include projects with vague biodiversity metrics, limited stakeholder engagement, or lack of transparent monitoring data. Investors should particularly scrutinize projects claiming biodiversity benefits without corresponding certification or third-party verification.

Strategic conservation investment requires careful portfolio construction — especially in a biodiversity investment fund — balancing risk, return, and impact objectives. Geographic diversification across biomes and continents reduces exposure to localized climate risks while capturing diverse biodiversity values.

A well-constructed portfolio might include tropical forest protection in Southeast Asia, mangrove restoration in Africa, and regenerative agriculture in Latin America, alongside active engagement with portfolio companies.

Ecosystem diversification provides natural hedging against sector-specific risks. Combining terrestrial and marine projects, forest and grassland initiatives, and protection versus restoration approaches creates resilient portfolios capable of delivering consistent returns across varying market conditions. This diversity also enables investors to support comprehensive biodiversity conservation addressing multiple extinction drivers.

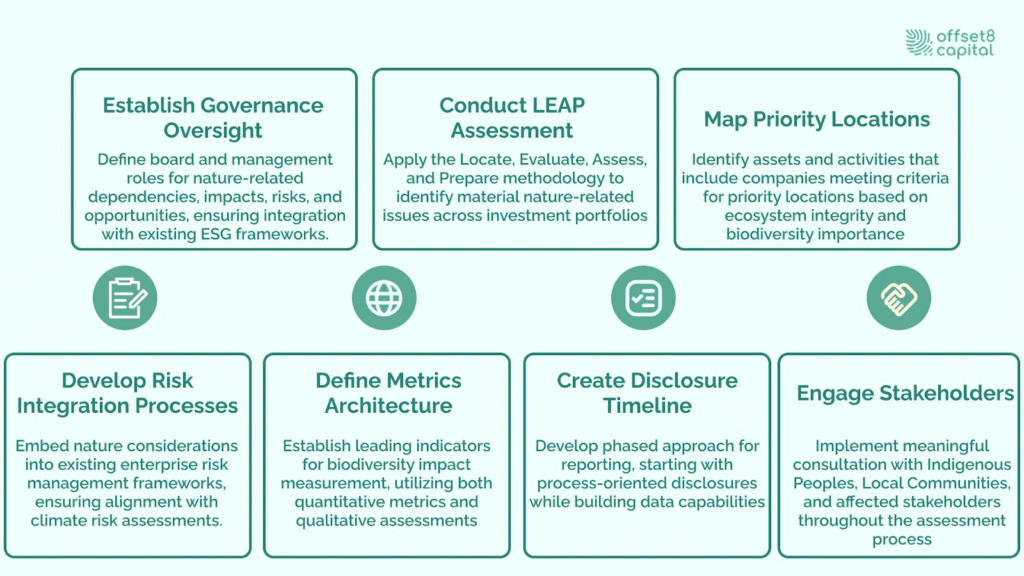

The Task Force on Climate-related Financial Disclosures (TCFD) framework represents a paradigm shift in how financial markets assess and manage nature-related risks and opportunities. It provides 14 recommended disclosures structured around four pillars: Governance, Strategy, Risk & Impact Management, and Metrics & Targets.

This framework aligns with the Kunming-Montreal Global Biodiversity Framework targets and responds to analysis by IPBES highlighting the urgent need to address the five drivers of nature degradation. The framework helps companies across sectors understand their dependencies on ecosystem services and biodiversity intactness.

Fig 4. TNFD Implementation Steps for Carbon Investors

The TNFD's LEAP approach offers practical guidance for identifying and assessing nature-related risks. This iterative process integrates with existing frameworks including the Natural Capital Protocol and Science Based Targets Network methods.

Recent surveys indicate that 86% of TNFD Forum respondents expect to begin reporting aligned with recommendations by 2026, demonstrating rapid market adoption.

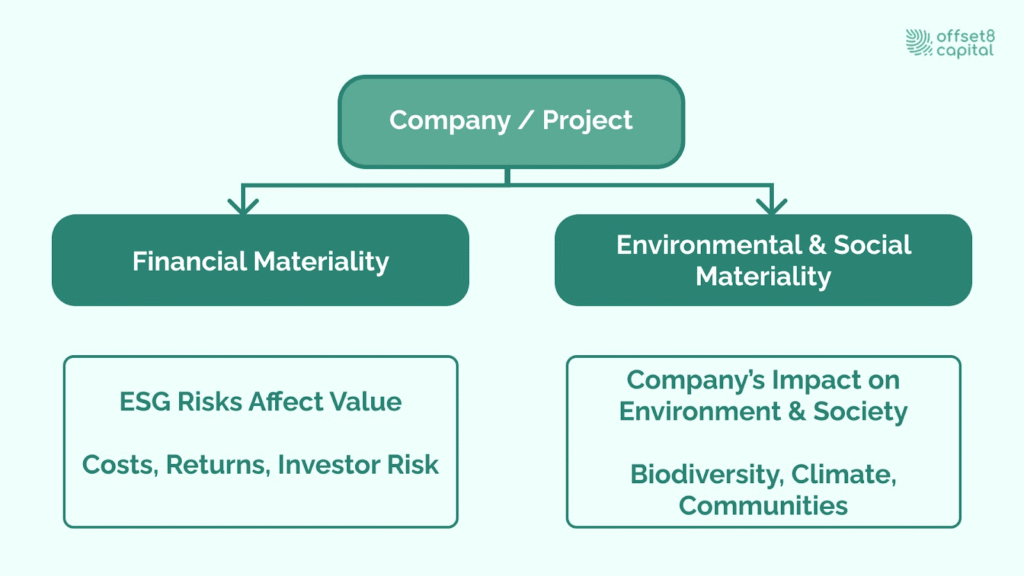

Ecosystem services valuation requires advanced methodologies that capture both direct and indirect dependencies. The TNFD framework uses a "double materiality" approach, considering both business impacts on nature and nature's effects on business performance.

This aligns with regulations like the Sustainable Finance Disclosure Regulation and the Regulation on Deforestation-Free Products, requiring companies to assess and disclose nature-related risks. It’s estimated that over half of global GDP depends on ecosystem services, highlighting the importance of this assessment for investment strategies.

Bottom-up approaches provide detailed insights into ecosystem service dependencies such as water regulation, pollination, and climate regulation. For carbon projects, understanding these dependencies is key to assessing long-term viability and permanence.

Fig 5. Double Materiality: Two Perspectives of Impact

Portfolio-level biodiversity metrics help investors aggregate and compare nature impacts across projects. Key metrics include species abundance, landscape connectivity, and habitat quality. Remote sensing and environmental DNA sampling are making large-scale biodiversity monitoring more cost-effective.

The growing biodiversity credits market offers a transformative opportunity for investors pursuing net zero and nature-positive strategies. Unlike carbon's standardized metric, biodiversity certificates require location-specific evaluations of ecological uniqueness. The market is projected to reach the scale of voluntary carbon markets within four years, driven by corporate nature commitments and regulatory support for biodiversity finance. Major corporations integrating biodiversity credits into their sustainability strategies highlight how responsible consumption drives market growth.

Hybrid carbon-biodiversity instruments, such as the Cusuco National Park project, combine carbon and biodiversity credits to maximize both environmental impact and financial returns. These integrated approaches attract broader investor participation while addressing the interconnected climate and biodiversity crises.

Post-COP16, the Global Biodiversity Framework supports biodiversity credits as innovative financing mechanisms, endorsing their market development. The framework's $200 billion annual target by 2030 creates significant demand for private sector biodiversity investments.

The 30% protection target for land and sea by 2030 requires massive capital mobilization — covering many million hectares of forest and marine habitats — which traditional funding cannot provide. Carbon projects integrating biodiversity protection contribute to these targets while generating returns, making them vital for global conservation goals.

Corporate commitments, such as science-based nature targets and TNFD adoption, are boosting market demand, supported by European regulations like the Nature Restoration Law and potential biodiversity disclosure requirements.

Biodiversity investment and carbon credits are reshaping how markets value natural systems. This shift offers institutional investors investment opportunities for superior returns while addressing biodiversity loss, benefiting investors and companies alike. Early adoption of biodiversity strategies positions any biodiversity investment fund for long-term success.

Biodiversity-enhanced carbon projects provide premium pricing, greater permanence, and improved risk mitigation. As market infrastructure evolves, early movers will capture significant value in sustainable finance.

Offset8 Capital, the Middle East’s first regulated carbon fund, helps investors navigate this space with expertise in identifying high-impact investments that deliver both financial returns and environmental benefits.

With biodiversity loss accelerating, the need for private investment in nature-based solutions is urgent. Acting now allows investors to capture emerging opportunities while protecting vital natural systems.

Disclaimer

*Disclaimer: This commentary is for informational purposes only and should not be considered financial, investment, or regulatory advice. Offset8 Capital Limited is regulated by the ADGM FSRA (FSP No. 220178). No assurances or guarantees are made regarding its accuracy or completeness. Views expressed are our own and subject to change

Carbon credits measure and certify reductions in greenhouse gas emissions, typically quantified in metric tonnes of CO₂ equivalent. These are standardized, fungible tools used in climate mitigation efforts.

Biodiversity credits, as defined by the Biodiversity Credit Alliance (BCA), represent measurable, lasting, and additional improvements in ecosystem health—such as restored habitats, increased species richness, or stronger ecological integrity.

The key distinction lies in their purpose: carbon credits focus narrowly on climate impact, whereas biodiversity credits value nature holistically.

Absolutely. Many carbon-credit projects now integrate biodiversity as a co-benefit rather than as a separate credit.

Biodiversity credits are an emerging voluntary market and face several development hurdles: