One of the most defining features of Japan’s carbon market is its focus on designing realistic regulations that consider the economic costs of decarbonization. Japan sets its climate ambition targets at achievable levels, taking a conservative yet highly feasible approach to reducing greenhouse gas emissions.

This strategy is rooted in Japan’s prolonged economic stagnation. Since the collapse of the economic bubble, the country has endured what is often referred to as the “lost three decades.” In light of this, Japan has chosen not to simply replicate the aggressive climate policies adopted in Europe. Instead, it is developing a uniquely tailored system that balances environmental goals with economic stability.

Japan’s decarbonization policy

A major development within this approach is the full-scale introduction of an emissions trading scheme (ETS) in April 2026. Under this scheme, approximately 300-400 companies that emit more than 100,000 tons of greenhouse gases annually will be required to participate. The ETS is expected to cover around 60% of Japan’s total emissions, marking a significant turning point for the country’s industrial sector. According to the Japanese Cabinet Office, to support this transition, the Japanese government has launched the Green Transformation (GX) Promotion Strategy. It outlines plans for over 150 trillion yen (Approx. 1.0 trillion USD) in public-private climate finance investment over the next decade, including a 20 trillion yen (Approx. 135 billion USD) early-stage investment package backed by GX Economic Transition Bonds. These efforts aim to create new markets and demand through a combined approach of financial incentives and institutional reforms.

Japan Business Federation (Keidanren) — the country’s most influential business organization — plays a major role in shaping decarbonization-related legislation. Keidanren’s input is a crucial factor in ensuring that proposed policies remain grounded in economic reality and are practically implementable for businesses pursuing sustainability goals.

Japan’s carbon market is currently in Phase 1, which centers on voluntary initiatives by companies. In Phase 2, scheduled to begin in 2026, a full-scale emissions trading system (ETS) will be launched, marking a major shift toward mandatory carbon pricing mechanisms. Back in 2006, Japan enacted Act on Promotion of Global Warming Countermeasures, requiring large-scale emitters (specified emitters) to calculate their greenhouse gas (GHG) emissions and report them to the government. The collected data is aggregated and published, ensuring transparency in emissions management.

Japan’s carbon credit framework has evolved in distinct stages:

2008:

J-VER (Japan Verified Emission Reduction): A voluntary offset program targeting GHG reductions by small businesses and local governments, primarily for the voluntary carbon market.

Domestic Credit Scheme: A system that allowed large companies to support GHG reduction efforts by smaller entities through funding or technical assistance, helping the former meet their own voluntary emission targets.

2011:

JCM (Joint Crediting Mechanism): A bilateral scheme launched by Japan in partnership with developing countries to collaboratively implement GHG reduction projects and share resulting credits.

2013:

J-VER and the Domestic Credit Scheme were integrated into the unified J-Credit Scheme, streamlining Japan’s domestic carbon credit system.

2023:

GX League was launched — a coalition of companies committed to accelerating carbon neutrality. The league includes corporations responsible for over 50% of Japan’s total GHG emissions and serves as a preparatory platform for participation in the upcoming national ETS. Under the first phase, “GX Credits” were introduced, allowing participating companies to trade surplus emission reductions ahead of the full-scale ETS launch.

In May 2025, Japan revised its GX Promotion Act, marking the beginning of full-scale discussions on the market design of the country’s upcoming emissions trading system (ETS).

On July 2, 2025, the first meeting of Subcommittee on the Emissions Trading System was held, during which the following key topics were discussed:

One of the most prominent messages from the meeting was that the Ministry of Economy, Trade and Industry (METI), together with the participating academics and business leaders, emphasized the need to advance decarbonization without imposing excessive restrictions on business activities. It was clearly indicated that policies will be designed with the goal of achieving both net-zero by 2050 and sustained economic growth (GX).

| Date | Key Discussion Items |

| July 2, 2025 (1st meeting) | - Establishment of the subcommittee- Initial framework for system coverage, calculation, and verification |

| August 2025 (2nd meeting) | - Overall allocation structure- Concepts for baseline emissions and activity levels |

| Fall 2025 (ongoing) | - Factors to consider in allocation: • Early reduction • Carbon leakage risks • R&D investment - Allocation methods (e.g., benchmarking, grandfathering) - Specific price floor and ceiling levels - Required elements for transition plans |

| By end of 2025 | - Compilation of final system design |

| April 2026 | - Full launch of Japan’s Emissions Trading System (ETS) |

Table 1: Subcommittee Timeline and Discussion Topics

Japan is also playing an active role on the international stage in promoting decarbonization.

In 2022, the country launched Asia Zero Emissions Community (AZEC) initiative to strengthen regional cooperation on climate action. Since then, the following key developments have taken place:

Under this framework, Japan aims to achieve carbon neutrality in partnership with Australia, Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, the Philippines, Singapore, Thailand, and Viet Nam.

AZEC serves as a multilateral platform for international climate cooperation, positioning Japan as a regional leader in low-carbon efforts. It also plays a critical role in expanding the international reach of Japan’s carbon market and policy influence in Asia's rapidly developing economies.

A notable example of this growing collaboration was presented at the AZEC Leaders Conference in December 2024, held in Laos. A groundbreaking MoU between Offset8 Capital, Faeger, and Sawa Eco Solutions was showcased as one of the key partnerships between Japanese companies and stakeholders from AZEC member states. The MoU was introduced by Japanese Prime Minister Shigeru Ishiba, highlighting its strategic importance. This trilateral agreement brings together companies from Japan, the UAE, and Indonesia to implement the Alternate Wetting and Drying (AWD) methodology in Indonesia, the world’s fourth-largest rice producer. The project aims to significantly reduce methane emissions while directly benefiting thousands of local rice farmers.

Japan’s carbon credit framework consists of two main schemes: the J-Credit Scheme, which functions as a domestic credit system, and the Joint Crediting Mechanism (JCM), an international bilateral crediting scheme. Each scheme operates under a different structure and purpose, but both play a vital role in Japan’s broader decarbonization strategy.

Joint Crediting Mechanism (JCM) is a carbon credit system established through partnerships between Japan and other countries. Under this mechanism, Japan facilitates the introduction of advanced decarbonization technologies, knowledge, or financial support to partner countries. The resulting greenhouse gas emission reductions or carbon removals are then shared between both countries, contributing to the achievement of their respective Nationally Determined Contributions (NDCs) under the Paris Agreement.

Since launching discussions in 2011, Japan has established JCM partnerships with 30 countries (as of July 30, 2025):

| Area | Country |

| Asia | Mongolia, Bangladesh, Maldives, Vietnam, Lao People's Democratic Republic, Indonesia, Cambodia, Myanmar, Thailand, Philippines, Sri Lanka, Uzbekistan, Kyrgyz Republic, Kazakhstan, Georgia, Republic of Moldova, Azerbaijan |

| Africa | Ethiopia, Kenya, Senegal, Tunisia, United Republic of Tanzania |

| Latin America & the Caribbean | Costa Rica, Mexico, Chile |

| Oceania | Palau, Papua New Guinea |

| Middle East | Saudi Arabia, United Arab Emirates (UAE) |

| Europe | Ukraine |

Table 2: Partner countries of JCM

JCMA: Japan’s Official JCM Implementation Agency

On April 1, 2025, under the revised Act on Promotion of Global Warming Countermeasures, Japan officially launched JCM Implementation Agency (JCMA) to manage and operate the mechanism. The designated operational body, Global Environment Centre Foundation (GEC), oversees the entire JCM process — from project registration and credit issuance to coordination with partner countries. The JCMA plays a central role in ensuring effective and transparent governance of Japan’s international carbon credit system.

J-Credit Scheme is a national program under which Japan certifies the amount of GHG emissions reduced or removed through activities such as:

The scheme is jointly administered by three government ministries:

the Ministry of the Environment, the Ministry of Economy, Trade and Industry, and the Ministry of Agriculture, Forestry and Fisheries.

Current Status (as of May 2025)

J-Credits’ Project Types

Individual (Standard) Projects: Projects that reduce emissions from a specific facility or location, registered individually.

Programmatic Projects: A structure that aggregates multiple small-scale emission reduction activities into a single project registration. This allows for greater overall reduction impact through collective implementation.

Government Target

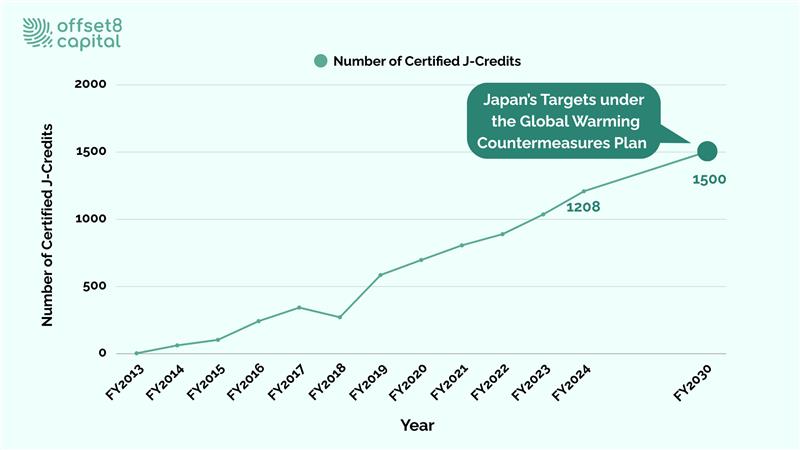

According to the Plan for Global Warming Countermeasures, approved by Japan’s Cabinet on October 22, 2021, the government has set a target of certifying 15 million t-CO₂ in J-Credits by fiscal year 2030.

Fig 1: Number of Certified J-Credits and Japan’s Targets under the Global Warming Countermeasures Plan

GX Credits are issued when companies participating in the GX League exceed their voluntarily set emission reduction targets. They were introduced during the first phase of the GX-ETS and are designed as a preparatory mechanism for the full-scale national Emissions Trading System (ETS) starting in FY2026.

GX Credits are issued under a voluntary scheme and are calculated based on actual performance against the emission reduction targets set within the GX League, rather than through project-based mechanisms like JCM and J-Credits. These credits can be used for trading and target compliance within the GX League and are scheduled to begin trading on the JPX Carbon Credit Market for a two-month period from November to December 2025, enhancing price transparency and improving overall market credibility.

Japan’s carbon credit trading market includes the JPX Carbon Credit Market and Tokyo’s Carbon Credit Market Platform, as well as various private-sector services. For a country like Japan, which tends to be conservative in business practices, the ability to visualize price fluctuations in carbon credits and price differences between projects carries significant value. The government is also actively supporting these initiatives.

As part of its national carbon pricing strategy, Japan Exchange Group (JPX) officially launched a carbon credit market on October 11, 2023. This initiative was based on the results of pilot projects conducted in fiscal year 2022 and aligned with the government’s “Basic Policy for Realizing GX (Green Transformation)”, which was approved by the Japanese

government in February of the same year.

The carbon credit market is distinct from traditional securities markets, such as those for listed stocks operated by the Tokyo Stock Exchange. It is positioned as Japan’s first step toward implementing a full-fledged emissions trading system (ETS).

| Items Eligible for Trading | J-Credits | GX Credits |

| Trading Method | Call auction at 11:30 a.m. and 15:00 p.m.(based on price priority) | Call auction at 15:00 p.m.(based on price priority) |

| Settlement Date | Fifth business day from day of execution (T+5) | Ninth business day from day of execution (T+9) |

| Type of Orders | Limit orders (market orders will not be accepted) | Limit orders (market orders will not be accepted) |

| Trading Categories | 9 categories sorted by project type (for J-Credits) | 1 category |

| Order Acceptance Hours | 8:00 – 11:29 / 12:30 – 14:59 | 8:00 – 14:59※Trading Days are Every Fridays(from November 2024 through February 2025.) |

| Tick Size | JPY 1 | JPY 1 |

| Trading Unit | 1t-CO₂ | 1t-CO₂ |

| Price Limits | ±90% of the reference price | ±90% of the reference price |

| Base Prices | 1. Final execution price of last auction2. Base price of last auction | 1. Final execution price of last auction2. Base price of last auction |

| Settlement | Transfer of cash and credits between buyer and seller | Transfer of cash and credits between buyer and seller |

Table 3: Overview of Specifications of JPX’s Carbon Credits Market

Eligibility and Tradable Credits (as of July 2025)

As of July 2025, the following entities are eligible to participate in JPX’s carbon credit market:

Currently, the only type of carbon credit available for trading in this market is the J-Credit.

| J-Credit (Energy Sector) | |

| J-Credit | Energy saving |

| Renewable energy (electricity) | |

| Renewable energy (electricity: woody biomass) | |

| Renewable energy (heat) | |

| Renewable energy (mixed electricity/heat) | |

| J-Credit (Agriculture and Carbon Sinks) | |

| J-Credit | Agriculture (Extension of mid-drying period) |

| Agriculture (Biochar) | |

| Forest sink | |

| Other | |

| Transferred and Other Credit Types | |

| Transferred from Domestic Credit Scheme | Domestic credits |

| Transferred from J-VER Scheme | J-VER (forest sink) |

| J-VER (other) | |

| Regional J-Credits, J-VERs (not yet transferred), regional J-VERs (not yet transferred), domestic credits (not yet transferred) | Regional J-Credits |

| J-VER (not yet transferred) forest sink | |

| J-VERs (not yet transferred) other | |

| Regional J-VERs (not yet transferred) | |

| Domestic credits (not yet transferred) | |

| GX credit | (Not specified) |

Table 4: Carbon Credits Tradable on JPX’s Carbon Credits Market

The Tokyo Metropolitan Government (TMG) has launched a range of initiatives aimed at achieving Zero Emission Tokyo, with a particular focus on helping small and medium-sized enterprises (SMEs) transition toward decarbonization and improved sustainability. As part of this effort, Tokyo officially began operating its own carbon credit market platform in 2025.

Supporting Credit Use by Small and Medium-Sized Enterprises

For SMEs to effectively decarbonize, in-house efforts such as energy-efficient equipment upgrades are essential but so is the strategic use of carbon credits.

To facilitate this, Tokyo has developed an independent platform that allows businesses to easily trade both domestic and international carbon credits.

The platform currently supports the trading of the following two types of credits:

As of now, only Japanese companies are eligible to register and participate on both the Tokyo Carbon Credit Market and the JPX Carbon Credit Market. However, the inclusion of foreign entities is under consideration for future development.

Both the JPX Carbon Credit Market and the Tokyo platform are based on over-the-counter (OTC) transactions, but they also aim to enhance market transparency through:

By increasing clarity in an industry previously marked by opacity, these platforms contribute to building a more reliable and accessible carbon credit ecosystem. Ultimately, this type of infrastructure is a step toward balancing economic gain with environmental impact, not only for Tokyo, but for Japan as a whole.

As the global climate shift toward decarbonization accelerates, Japanese companies and investors must take a strategic approach to both emissions management and the use of carbon credits.

This section outlines key action points for businesses and critical perspectives for investors.

Emissions Management and Credit Utilization for Companies

The first priority for companies is to accurately measure their GHG emissions.

Since April 2006, under the Act on Promotion of Global Warming Countermeasures, Japan’s Ministry of the Environment has required designated emitters — businesses that emit GHGs above a certain threshold — to calculate and report their emissions to the government.

Even for companies not currently subject to this regulation, it is highly advisable to begin voluntary emissions tracking in anticipation of future regulatory requirements. Guidance on reporting procedures and technical requirements is available through the Ministry of the Environment’s official documentation.

How Carbon Market Could Impact Investment Volatility in Japan

For investors, it is essential to closely monitor developments in emissions trading schemes (ETS). In particular, the following factors can significantly impact portfolio risk and return:

One promising area of opportunity is direct investment in carbon removal projects and clean energy initiatives. Projects and funds linked to JCM and J-Credit Scheme are especially noteworthy, given their strong ties to Japan’s domestic carbon market and the anticipated growth in credit demand in the years ahead.

Securing High-Quality Credits and Managing Risk

Japan is entering Phase 2 of its carbon market, marking the start of its national ETS. This phase introduces a penalty-based mechanism, where companies face financial consequences for excess emissions.

Initially, regulations will focus on large-scale emitters — particularly in the energy sector — but will gradually expand to other industries. In a recent meeting hosted by the Ministry of the Environment, the government announced a policy allowing up to 10% of emissions to be offset using J-Credits or JCM credits. Although this cap may change in the future, the need for companies to incorporate credits into their compliance strategy is inevitable.

Credit Price Volatility and the Importance of Early Action for Climate Goals

Carbon credit prices are highly sensitive to changes in supply and demand. Demand spikes — especially around regulatory enforcement or ETS rollout — can drive rapid price increases. There is a real risk that credits may become prohibitively expensive right when companies need them most.

A relevant example is CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), a global framework introduced by ICAO (International Civil Aviation Organization).

Under CORSIA, airlines are required to offset emissions using only CORSIA-eligible credits, which meet strict environmental criteria.

Due to limited supply and rapidly growing demand from international carriers, credit prices have surged, and further increases are expected. This type of market pressure could easily occur in Japan as well. For instance, risks such as the expansion of the ETS, a reduction in allowable offset percentages, or sudden policy shifts could all trigger a surge in credit demand.

Any of these factors could trigger a scramble for credits, leading to dramatic price spikes.

Therefore, it is vital that both companies and investors develop forward-looking strategies for credit procurement and portfolio planning now, before market conditions tighten.

Assessing Credit Quality and Avoiding Greenwashing

While low-cost credits may seem attractive, it is crucial to verify their legitimacy and environmental integrity. Buyers should evaluate:

Careful due diligence helps companies avoid reputational damage and accusations of greenwashing — claiming to be environmentally responsible without real impact. Securing high-quality credits not only enhances environmental outcomes but also strengthens corporate credibility and mitigates reputation-related risks.

Offset8 is a global emissions investment and management group founded in Abu Dhabi, United Arab Emirates. At COP28, Offset8 announced the Middle East's first carbon market fund with target size of $250m.

Offset8 seeks to finance nature-based solutions in Africa and Southeast Asia, as well as provides financing in the form of prepayments and offtake contracts for the delivery of verified carbon credits, with subsequent sale of the carbon credits under compliance markets (e.g., CORSIA and regional ETS), Article 6 of the Paris Agreement or voluntary purposes.

Offset8 Capital has an existing pipeline of approximately 70 projects: the investment portfolio includes such projects as CORSIA-eligible iRise (Malawi's largest reforestation and clean cooking program), Sawa (Indonesia's largest biochar carbon removal project), and others. These projects undergo rigorous verification, ensuring institutional investors receive premium carbon credits that meet evolving regulatory requirements. Our commitment to carbon neutrality across Scope 1, 2, and 3 emissions aligns with Science-Based Targets initiative requirements, demonstrating institutional leadership while providing credible expertise for client engagement on climate strategy development.

We work closely with Japanese companies on their decarbonization efforts, drawing on global experience and local networks. Our bilingual team provides end-to-end support, from project design and certification to credit issuance and market entry. We cover key mechanisms including AWD, biochar, Article 6 of the Paris Agreement, and CORSIA. As Japan’s carbon market evolves, Offset8 Capital offers strategic, globally informed support to help companies lead in the climate transition toward net zero.

Disclaimer

*Disclaimer: This commentary is for informational purposes only and should not be considered financial, investment, or regulatory advice. Offset8 Capital Limited is regulated by the ADGM FSRA (FSP No. 220178). No assurances or guarantees are made regarding its accuracy or completeness. Views expressed are our own and subject to change

Japan’s national emissions trading system (ETS) is scheduled to begin full operation in 2026. Preparatory initiatives, such as the GX League and carbon credit trading platforms, are already underway.

J-Credits are issued by the Japanese government for verified emission reductions or removals within Japan. JCM credits, on the other hand, are generated through bilateral projects between Japan and developing countries under the Joint Crediting Mechanism.

As Japan’s national emissions trading system launches in 2026, foreign companies can partner with local players on climate projects or fund emissions reduction initiatives. Early entry helps shape market practices and tap into rising demand for credible credits.