As the impacts of climate change become increasingly severe, countries around the world are strengthening cooperation toward achieving carbon neutrality by 2050. At the heart of this global effort lies Article 6 of the Paris Agreement.

Article 6 of Paris Agreement establishes international rules that allow countries to share the outcomes of their greenhouse gas (GHG) reduction efforts and collectively advance global emission reductions in a more efficient and cost-effective way. Through this framework, governments, companies, and investors can collaborate across borders to generate and trade high-quality carbon credits with transparency and credibility.

This article provides a clear overview of the structure of Article 6, its three core mechanisms, its importance for businesses and investors, current developments in different countries, and future prospects for the global carbon market.

Article 6 of the Paris Agreement defines how countries can cooperate to implement emission reductions. These mechanisms are designed to raise climate ambition, promote sustainable development, and ensure environmental integrity through transparent international cooperation. It establishes the concept of Internationally Transferred Mitigation Outcomes (ITMOs), enabling one country to transfer verified emission reductions to another for use toward its national climate target. From a business and investor perspective, Article 6 is a key framework for creating a global market that enables the issuance and trade of high-integrity carbon credits.

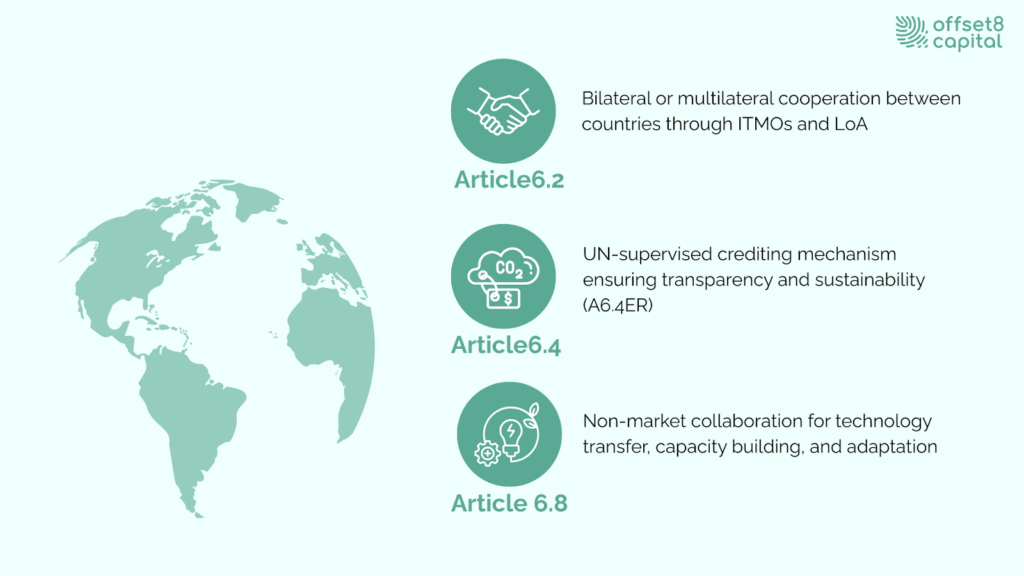

Article 6 establishes three cooperative approaches that enable countries to work together in achieving their climate targets. These mechanisms aim to enhance global mitigation ambition by promoting international cooperation, transparency, and integrity in carbon markets.

Fig1: The Three Cooperative Mechanisms of Article 6 under the Paris Agreement

Article 6.2 provides a framework for bilateral or multilateral cooperation between countries.

Through this mechanism, nations can collaborate and transfer mitigation outcomes, known as ITMOs (Internationally Transferred Mitigation Outcomes), from one country to another.

These outcomes can then be applied toward each country’s Nationally Determined Contribution (NDC), provided that both sides maintain robust accounting and transparency systems.

Each participating country must establish clear rules for authorization, reporting, and corresponding adjustments to prevent double counting.

To formally operate under Article 6.2, both the host and acquiring governments must issue a Letter of Authorization (LoA), which officially certifies that the project’s emission reductions are approved for international transfer.

The LoA also specifies which country will claim the reduction toward its NDC and under what conditions the transfer can occur.

Once an LoA is issued, the project is recognized internationally, allowing for transparent and accountable trading of credits. By providing flexibility for customized agreements between nations, Article 6.2 acts as the foundation of the Paris-aligned carbon market.

The Article 6.4 mechanism, supervised by the UNFCCC Article 6.4 Supervisory Body, establishes a centralized crediting system similar to the Clean Development Mechanism (CDM) under the Kyoto Protocol, but with stronger safeguards. It allows emission-reduction or removal projects in developing and emerging economies to generate Article 6.4 Emission Reduction (A6.4ER) credits that can be traded internationally.

This mechanism is designed to ensure high environmental integrity, requiring that each project demonstrate measurable and additional reductions, contribute to sustainable development, and avoid negative social or environmental impacts. It also includes a grievance process, standardized baselines, and transparent public reporting, all aimed at ensuring credibility and traceability.

Once fully operational, Article 6.4 could serve as the backbone of a UN-recognized carbon credit market, complementing national and voluntary systems. Discussions are ongoing about integrating Article 6.4 credits with voluntary standards such as Gold Standard or Verra, ensuring alignment with the Paris Agreement’s global accounting framework.

Unlike the other two mechanisms, Article 6.8 promotes cooperation that does not involve credit trading or financial transactions. It focuses on policy-based and sectoral collaboration, including technology transfer, capacity building, and adaptation measures that support sustainable development.

For example, non-market approaches may include joint research on low-carbon agriculture, renewable energy partnerships, or frameworks for just transition in developing economies.

This mechanism is essential for ensuring that global climate cooperation extends beyond markets and benefits countries that may lack access to credit-based financing.

Article 6.8 thus represents the inclusive dimension of the Paris Agreement, strengthening solidarity and knowledge sharing among nations.

Article 6 provides an international framework for achieving each country’s climate targets (NDCs) more efficiently and at lower cost.

Rather than pursuing reductions independently, countries can collaborate by investing in or purchasing high-impact mitigation projects in other regions, leading to greater overall global reductions. This flexibility benefits not only governments but also companies and investors that engage in carbon credit transactions.

Moreover, the integrity requirements of Article 6 are closely reflected in the CORSIA scheme (Carbon Offsetting and Reduction Scheme for International Aviation). The International Civil Aviation Organization (ICAO) requires that offset credits used under CORSIA be aligned with the Paris Agreement.

By using Article 6-compliant credits, companies can report their offsetting activities in a manner consistent with international standards, strengthening both transparency and credibility. For investors, the framework encourages capital flows into high-quality, verifiable projects, while promoting risk diversification and new opportunities for collaboration with developing countries.

Several countries have already begun implementing Article 6 in practice.

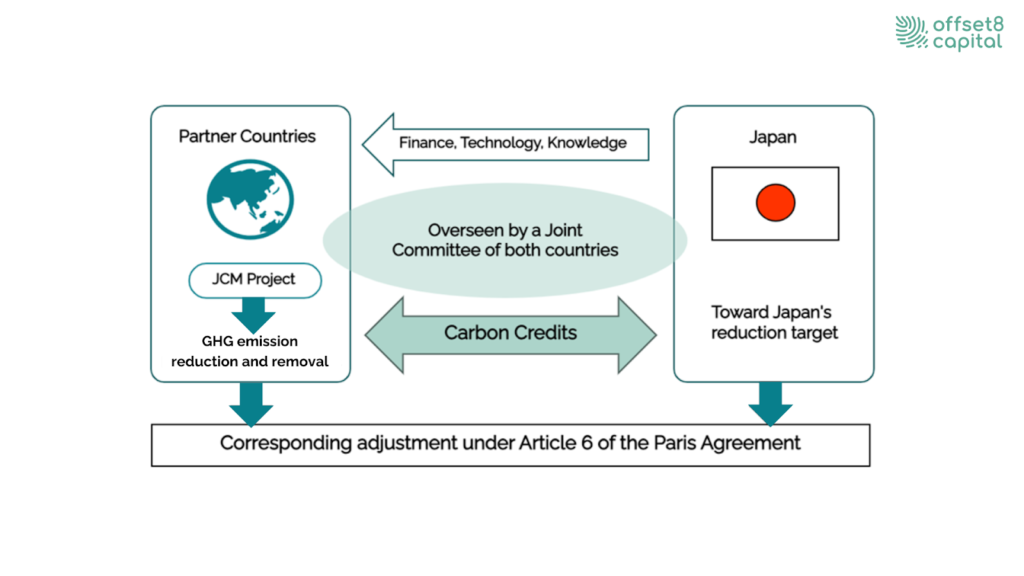

Japan, for instance, operates the Joint Crediting Mechanism (JCM) with more than 31 partner countries across Asia and Africa, supporting emission-reduction activities such as energy efficiency, renewable energy, and nature-based solutions such as rice paddy water management (AWD).

Fig 2: Japan’s JCM Scheme: A Bilateral Model under Article 6

In Africa, policy frameworks for Article 6 are also advancing. Countries such as Zambia and Malawi are developing national systems for authorization and registry to participate in international carbon trading. These developments show that Article 6 is no longer a theoretical concept but an emerging reality, driven by cooperation between governments and the private sector.

At the same time, discussions continue around ensuring the quality and accuracy of credits. Independent monitoring and transparency remain essential to maintain trust in the market.

Implementing Article 6 still presents several challenges. One of the most critical is the avoidance of double counting, where the same emission reduction could be claimed by both the host and acquiring country. To prevent this, each country must apply corresponding adjustments and maintain robust reporting frameworks.

Projects authorized by both the host and acquiring governments through a Letter of Authorization (LoA) ensure international alignment and transparency, making their credits more reliable and credible for companies and investors.

Ensuring the quality and integrity of issued credits is equally important. Projects must demonstrate real and measurable emission reductions and contribute positively to sustainable development in host communities.

In the coming years, the circulation of the Paris Agreement–aligned credits is expected to accelerate, further advancing the integration of the global carbon market.

Companies and investors will need to view carbon credits not merely as tools for offsetting, but as strategic assets that support long-term sustainability objectives. It will be essential to assess whether projects are already compliant with Article 6 rules or can be structured to achieve compliance in the future.

When purchasing credits or selecting investment opportunities, due diligence on national authorization systems (LoA), certification frameworks, and audit histories will be critical to ensure credibility and transparency.

By aligning corporate carbon strategies with the Article 6 framework, businesses can anticipate regulatory changes, mitigate future risks, and enhance their competitiveness in the sustainability economy. When considering investments in carbon credits, it is also important to collaborate with experts to identify reliable, high-integrity projects.

Ultimately, Article 6 represents not merely a new way of reducing emissions, but a foundation for deeper international cooperation and responsible climate finance.

Article 6 provides a global framework for countries to cooperate in addressing the shared challenge of climate change. By allowing nations to share mitigation outcomes and technologies, it enables more efficient and equitable global emission reductions.

At its core, the mechanism embodies the principle that protecting the planet is a collective responsibility.

As Article 6 implementation progresses, the carbon market is expected to evolve toward greater transparency, integrity, and interconnection. Beyond environmental benefits, this will generate broader social value, including community investment, job creation, and technology transfer.

For companies and investors, Article 6 is more than a compliance mechanism; it is a foundation for long-term sustainability strategy. Choosing high-integrity credits and engaging responsibly in international cooperation will be key to maintaining both credibility and competitiveness in the global transition to net zero.

It is an international framework under the Paris Agreement that allows countries to share the results of their greenhouse-gas reduction efforts. Governments and companies can collaborate on mitigation projects and transfer credits between nations.

The voluntary market focuses on voluntary offsetting, while Article 6 is directly linked to national climate targets (NDCs). It requires government authorization and has mechanisms to prevent double counting.

By using Article 6-aligned credits, companies can report their emission reductions in a globally recognized way. Schemes such as CORSIA also require the use of credits consistent with Article 6.